If you’ve ever been hit with an NSF (non-sufficient funds) fee, you know that it’s costly and inconvenient. With overdraft or coverdraft protection, you can avoid such fees, often for free. Here’s how to set up overdraft protection at Tangerine Bank.

You get charged an NSF fee if there is a debit against your account (such as someone cashing a cheque you wrote) and you do not have enough money in your account to cover the debit. By default, your account is not allowed to be “overdrawn” — in other words, it cannot have a negative balance. Tangerine’s NSF fee is $40. Not only are you charged the fee, but your cheque bounces and you’ll have to re-do the transaction (such as issuing a new cheque) when you have enough money in your account again. You might also get charged another fee by the recipient to cover their inconvenience.

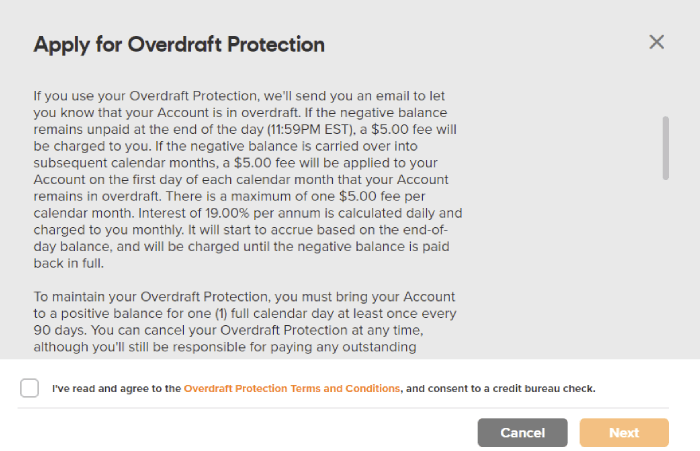

Overdraft protection allows your account to go into a negative balance (up to a certain limit). At Tangerine, you must apply to have this protection enabled. Overdraft protection at Tangerine is free if you do not use it at all, or when you use it, if you transfer enough money into the account by 9:00pm Pacific time / 12:00am Eastern time on the night that your account is overdrawn. Otherwise, it costs $5 in each month that you use it (no matter how many times you use it in a month), plus 19% annual interest until the overdraft amount is paid back. Tangerine will e-mail you whenever you’ve overdrawn your account.

Setting up overdraft protection at Tangerine Bank

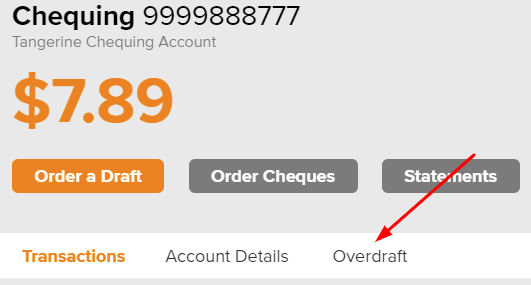

First, in your online interface, click the “Overdraft” link on your chequing account:

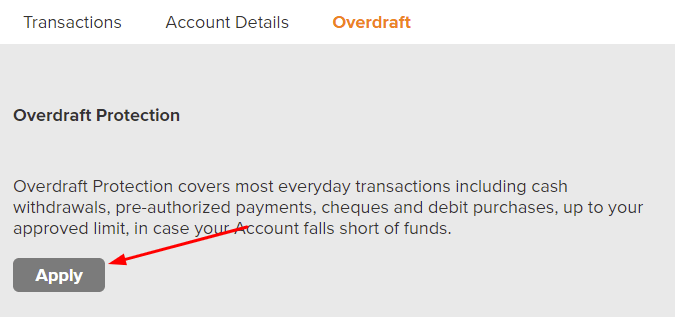

Then, click the “Apply” button:

Then, agree to the terms:

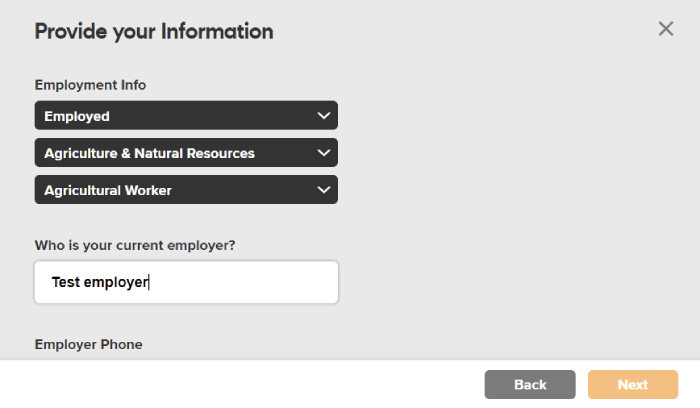

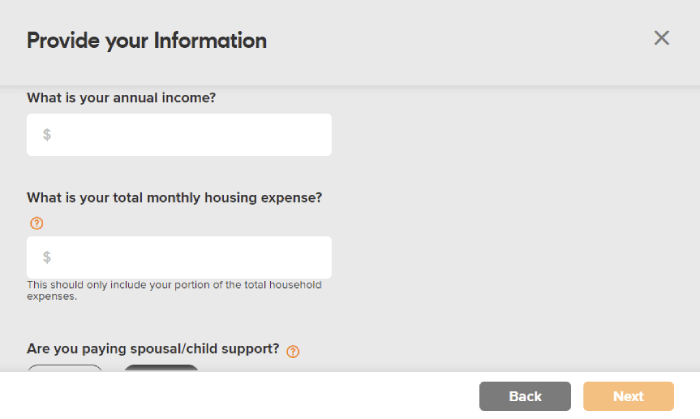

Finally, fill in the application form, which asks for your employment information as well as other personal information:

In some cases, you’re done and are approved immediately. Note that it does a credit bureau check and you might get denied.

How to avoid overdraft fees

If you have enough money in your Tangerine savings account, you can simply transfer the money instantly to the chequing account the same day that an overdraft occurs. Otherwise, if you have enough money elsewhere, consider sending yourself an Interac e-Transfer from another financial institution, since the money transfers close to instantly, allowing for what is usually less than a 30 minute delay between when you send the Interac e-Transfer and when you receive an e-mail or phone link to deposit the money. Many financial institutions offer free Interac e-Transfers on no-fee accounts, including Alterna Bank, EQ Bank, and Motive Financial. (Credit to forum user Adam1 for the idea!)

Not a client of Tangerine Bank? Other financial institutions offer similar overdraft features, including “coverdraft” from Alterna Bank, which triggers an automatic, internal transfer of money between your Alterna Bank accounts whenever one of them is overdrawn.