Website: https://www.happysavings.ca

Headquarters: Selkirk, Manitoba

Parent company: Access Credit Union

Credit union? Yes

Available to Quebec residents? No

Founded in: 2010

Disclaimer: Although our best efforts are made, the information posted on this website is not guaranteed to be accurate. Please visit their website for authoritative information.

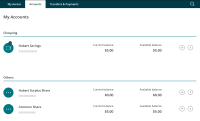

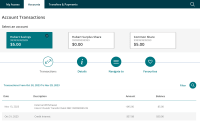

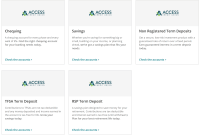

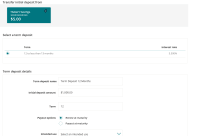

Interface screenshots

Latest discussions about Hubert Financial -- view all

| Forum/Topic | Started | Last post | Posts |

|---|---|---|---|

|

Hubert Financial |

3 | ||

|

Hubert Financial |

15 | ||

|

Hubert Financial |

8 | ||

|

Hubert Financial |

39 | ||

|

Hubert Financial |

3 |

Facebook

Facebook Twitter

Twitter Email this

Email this

Customer service: Rated 5 / 5 stars

Account features: Rated 3 / 5 stars

Interest rates (consistency and amount): Rated 3 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 5 / 5 stars

How long have you banked with them?: 1.5 years

Why do you bank with them?: high interest rates

What do you like about this bank / credit union?: it is a credit union; great customer service

What could be improved about this bank / credit union?: to access money one has to do etransfers; I tried to connect the account with my chequing account at Tangerine and it failed; process seemed too complicated (mail in form etc), so I stopped

General comments: would recommend; unfortunately interest rates on savings declined

Review by Maike — January 4, 2025 @ 9:33 am

Customer service: Rated 3 / 5 stars

Account features: Rated 1 / 5 stars

Interest rates (consistency and amount): Rated 3 / 5 stars

Fees:

Interface (online, telephone, in-person, etc.): Rated 2 / 5 stars

How long have you banked with them?: about 10 years

Why do you bank with them?: Because of merger of Sunova Credit Union with Access Credit

What do you like about this bank / credit union?: Not much

What could be improved about this bank / credit union?: Access CU have done everything to ensure the the previously good Old Hubert fails and it has.

General comments: Quarterly Term Deposits (GIC's) used to have very competitive interest rates, even when interest dropped in the past with the Old Hubert. It appears Access CU is making them less desirable, possibly hoping to eventually remove them from the current list of available options.

Review by The Good Old Reliable Hubert is Dead. — December 19, 2024 @ 4:05 pm

Customer service:

Account features:

Interest rates (consistency and amount): Rated 4 / 5 stars

Fees:

Interface (online, telephone, in-person, etc.): Rated 3 / 5 stars

How long have you banked with them?: 9+ Years with Hubert/Sunova CU. to June 2022. Then from July 2022 with Hubert/Access CU.

Why do you bank with them?: Because of the of July 1, 2022 merger of Sunova Credit Union with Access Credit Union

What do you like about this bank / credit union?: To be determined.

What could be improved about this bank / credit union?: Since the September 22-24 integration, several options and features previously available on the Hubert website are no longer available. It would be nice to get some of them back.

General comments: It should be noted, All Reviews posted prior to the September 2023 integration are no longer valid. They are only related to the previous Hubert/Sunova history, and are not related to any new Hubert/Access CU. reviews.

Review by guardian — December 3, 2023 @ 10:59 am

Customer service: Rated 5 / 5 stars

Account features: Rated 4 / 5 stars

Interest rates (consistency and amount): Rated 5 / 5 stars

Fees:

Interface (online, telephone, in-person, etc.): Rated 4 / 5 stars

How long have you banked with them?: 7 months

Why do you bank with them?: Great rates

What do you like about this bank / credit union?: Redeemable GIC

What could be improved about this bank / credit union?: Should be able to redeem GIC without contacting customer care

General comments: Great rates on the remake GIC

Review by TJ — March 13, 2023 @ 3:39 pm

Customer service: Rated 5 / 5 stars

Account features: Rated 5 / 5 stars

Interest rates (consistency and amount): Rated 5 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 5 / 5 stars

How long have you banked with them?: 7 years

Why do you bank with them?: Easy to use, good rates/products and local for me.

What do you like about this bank / credit union?: See above

What could be improved about this bank / credit union?: It is pretty good for what I use it for.

General comments: I've always had great service with Hubert. From fixing a mistake I made to just general transactions.

Review by Lloyd — October 10, 2021 @ 11:39 am

Customer service: Rated 5 / 5 stars

Account features: Rated 5 / 5 stars

Interest rates (consistency and amount): Rated 5 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 5 / 5 stars

How long have you banked with them?: For over 5 years

Why do you bank with them?: Their one year three month cashable at anytime GICs as well as cad and usd accts

What do you like about this bank / credit union?: Always improving their online site. As a transfer point for push/pull with easy link setups.

What could be improved about this bank / credit union?: Currently does the job

General comments: Nothing now

Review by Richard — May 31, 2020 @ 9:23 am

Customer service: Rated 5 / 5 stars

Account features: Rated 5 / 5 stars

Interest rates (consistency and amount): Rated 5 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 5 / 5 stars

How long have you banked with them?: Several years

Why do you bank with them?: Interest rates & prompt customer service

What do you like about this bank / credit union?: I REALLY like their one year quarterly gic that pays interest quarterly and allows you to change our at any time - common sense would be to do it on the quarterly interest pay date . Their interest rates have not been as good as motive , but good enough for me to stay and unlike motive they have locked in rates . I also like that it’s very easy to pull and push money to and from other institutions

What could be improved about this bank / credit union?: Their website is still a work in progress ( the new site ) but one can continue to use the old one while they continue to improve the new one

General comments: Nothing else

Review by Helen W — March 14, 2020 @ 10:10 am

Customer service: Rated 1 / 5 stars

Account features: Rated 1 / 5 stars

Interest rates (consistency and amount): Rated 3 / 5 stars

Fees: Rated 3 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 1 / 5 stars

How long have you banked with them?: 5 year

Why do you bank with them?: online

What do you like about this bank / credit union?: this website

What could be improved about this bank / credit union?: improve IT system

General comments: the IT platform is poor

Review by rateca — August 28, 2019 @ 1:02 pm

Customer service: Rated 5 / 5 stars

Account features: Rated 5 / 5 stars

Interest rates (consistency and amount): Rated 3 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 5 / 5 stars

How long have you banked with them?: 3 years

Why do you bank with them?: Had good rates on savings accounts when I signed up.

What do you like about this bank / credit union?: This site.

What could be improved about this bank / credit union?: I wish they kept their interest rates competitive

General comments: Would highly recommend when the rate is right.

Review by Mark — June 21, 2019 @ 1:46 pm

Customer service: Rated 5 / 5 stars

Account features: Rated 4 / 5 stars

Interest rates (consistency and amount): Rated 4 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 3 / 5 stars

How long have you banked with them?: 2 years

Why do you bank with them?: Great rates - good telephone customer service

What do you like about this bank / credit union?: Good rates - Good telephone customer service - No limit insurance on deposits.

What could be improved about this bank / credit union?: Website - if you have several deposits, it takes too long to sort out which account you are querying - would also like to see more up front security questions.

General comments: Patient, thorough, relaxed telephone customer service. Web site needs work to make it more user friendly.

Review by Bob — April 16, 2019 @ 9:23 am

Customer service:

Account features: Rated 5 / 5 stars

Interest rates (consistency and amount):

Fees:

Interface (online, telephone, in-person, etc.):

How long have you banked with them?: 3 YEARS

Why do you bank with them?: VERY GOOD RATES

What do you like about this bank / credit union?: SERVICE AND RATES

What could be improved about this bank / credit union?: NIL

General comments: NIL

Review by CHARLES ROY — December 23, 2018 @ 8:53 am

Customer service: Rated 5 / 5 stars

Account features: Rated 4 / 5 stars

Interest rates (consistency and amount): Rated 5 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 4 / 5 stars

How long have you banked with them?: About 2 years

Why do you bank with them?: Very straightforward. Great for short term savings and GICs.

What do you like about this bank / credit union?: I like the philosophy of credit unions (a people's bank). No fees. Better than average interest rates. Their online chat for service is very easy to use and they respond quickly. Really like the 1-year term deposit that can be cashed out quarterly - gives a higher rate, and nearly as convenient as a high interest savings account.

What could be improved about this bank / credit union?: Not much. I understand this is a virtual bank. Their services will be more limited, so they can offer a better rate.

General comments: If you're looking for an online bank with good overall rates, you can't really complain with this one.

Review by Paul — February 12, 2018 @ 9:51 pm

Customer service: Rated 5 / 5 stars

Account features: Rated 4 / 5 stars

Interest rates (consistency and amount): Rated 4 / 5 stars

Fees: Rated 5 / 5 stars

Interface (online, telephone, in-person, etc.): Rated 5 / 5 stars

How long have you banked with them?: 2 months

Why do you bank with them?: RBC killed Ally and IngDirect interest rates are too low.

What do you like about this bank / credit union?: No Fee Banking, with with a simple, easy user friendly website.

What could be improved about this bank / credit union?: Not an issue for me, but they do not have mutual funds.

General comments: For HISA and TFSA HISA and Term Deposits, they provide the ease and convenience that Ally and ING offered without fees and higher interest rates!

Review by Don Cunningham — April 17, 2013 @ 10:42 pm