Topic RSS

Topic RSS

9:26 am

September 30, 2017

Offline

OfflinePicking up from an old thread. It is a good idea!

TFSA discussions here dated back to the beginning (2009). It has been an useful wealth-accumulation tool to me. Currently, size of my very own tax-free shelter has grown to ~$130K. That is ~$5,200 tax free income annually if fully utilized & earning, say at 4% 🙂

At my stage, RRSP/RRIF will continue to decrease whereas TFSA will continue to increase!

10:11 am

January 12, 2019

Offline

Offline1:38 pm

September 30, 2017

Offline

Offline1:49 pm

October 27, 2013

Online

OnlineFrom https://www.planeasy.ca/the-new-tfsa-contribution-limit-how-big-could-your-tfsa-get-if-you-contribute-the-max-each-year/ if a person contributed the maximum each year since the start in 2009, and invested in a stock/bond ETF market index portfolio, at the end of 2023, one would have:

60/40 portfolio - $130k

80/20 portfolio - $139k

100/0 portfolio - $148k

I lost some ground by being invested only in a GIC ladder for the first several years until I woke up one day saying that since I had no need to tap into it at any time in the indefinite future, why was I not being more proactive? I switched to a 100% equity ETF thereafter as soon as the GICs started maturing, so I am now closer to $130k than I would have been to $148k if I had been 100% equity ETF from day one.

2:24 pm

October 21, 2013

Offline

OfflineContribution limit for 2024 will be increased to $7K.

Not a big surprise, but good to know.

https://www.taxtips.ca/tfsa/tfsa-contribution-rules-and-limits.htm

3:24 pm

January 12, 2019

Offline

OfflineLoonie said

Contribution limit for 2024 will be increased to $7K.

Not a big surprise, but good to know.https://www.taxtips.ca/tfsa/tfsa-contribution-rules-and-limits.htm

WOW ... That's the first time they increased the max limit, Two years in a row ❗

I guess we can thank the recent inflation for that.

Thanks for the heads-up, Loonie.

-

Dean

" Live Long, Healthy ... And Prosper! "

" Live Long, Healthy ... And Prosper! "

4:23 pm

September 28, 2023

Offline

Offline5:09 pm

September 30, 2017

Offline

Offline5:20 pm

October 27, 2013

Online

Onlinehwyc said

Why stop if no emergency fund? Why can't TFSA be an emergency fund account? Did they mean to stop at WealthSimple?

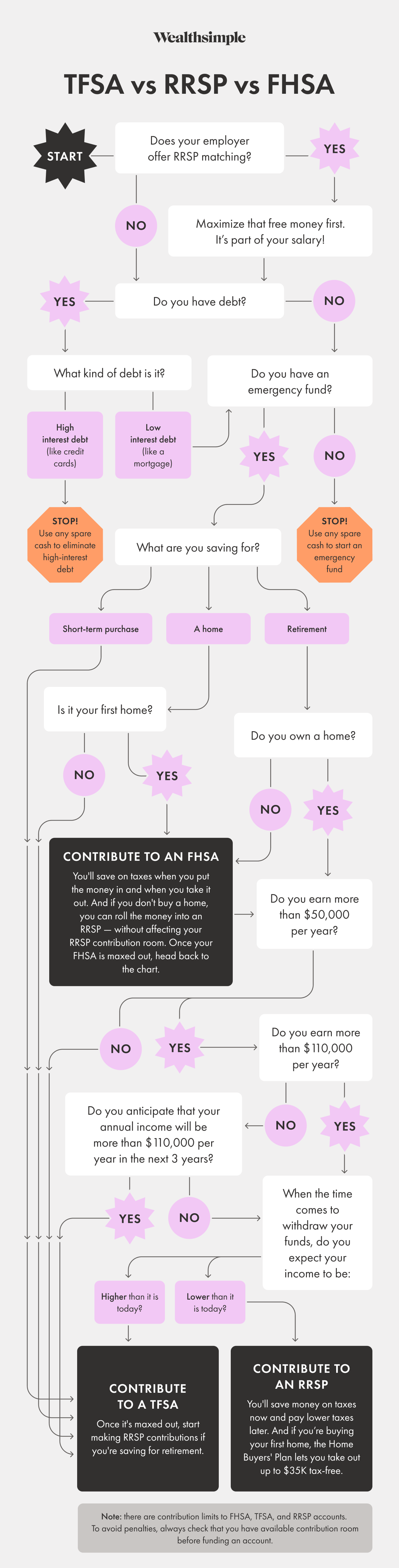

The way the flowchart seems to be presented is an assumption the funds in a TFSA would be "invested" as compared to restricting assets to "liquid savings" available on very short notice. The flowchart does acknowledge TFSA assets could be used for "short term purchases" but it does not appear to assume the kind of liquidity an emergency fund would normally have.

IOW, why waste TFSA room with an HISA?

10:02 pm

September 28, 2023

Offline

Offlinehwyc said

Why stop if no emergency fund? Why can't TFSA be an emergency fund account? Did they mean to stop at WealthSimple?

Depends how often an emergency fund is used. If the emergency fund is in a TFSA and is used early in the year, those funds can't be replaced in the TFSA until the following year (assuming contributions are maxed out).

5:22 am

March 30, 2017

Offline

Offline6:00 am

November 8, 2018

Offline

Offline6:46 am

September 30, 2017

Offline

Offline8:45 pm

September 29, 2017

Offline

OfflineShort of the new FHSA, the simplest way to think about a TFSA vs RRSP is one of the last questions; Do you expect your personal income to be higher than the present? If so, invest in a TFSA, otherwise RRSP is better.

This includes strategies that may reduce your personal income in the future by legally moving assets and investments into separate entities not in your name, e.g. incorporations, trusts, etc.

3:59 pm

September 30, 2017

Offline

OfflineThis year I learned to use TFSA as a tool for "wealth transfer to next generation"... in addition to joint-tenancy-with-rights-of-survivorship (JTWROS) accounts.

Simply name your beneficiaries. However, to that end, I believe one must intentionally leave the "successor holder" blank. Otherwise successor holder will take precedence, unless the named successor is no longer eligible at such time.

Skipping or neglecting to designate a successor holder or beneficiary on the TFSA plan, your TFSA assets will form part of your estate & subject to probate taxes.

Am I correct?

4:13 pm

October 27, 2013

Online

OnlineIt may depend on the institution. Most can have a primary such as Successor Holder and contingency beneficiaries should the Successor Holder pre-decease the account owner.

In the absence of any beneficiary designation, the account defaults to the Estate and subject to any specific provisions provided for in the Will.

Personally, I think it is important to name a beneficiary(ies) for the TFSA to avoid having it subject to probate and to get an early payout to the named beneficiaries.

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.