Topic RSS

Topic RSS

2:19 pm

June 15, 2016

Offline

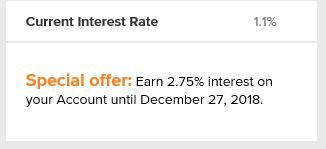

OfflineTangerine Marketing department is calling targeted customers and offering them

2.75 % for 270 days.

You will get a call from : 416-758-5025 , its a legit call & offer you the 2.75 % for

270 days - so basically almost till the end of the year. Great offer, since its 2.75 % and ON entire balance. See if you can call in & try to get this offer 🙂

Usually you have to call them, but here they are calling you OUTBOUND from their marketing call centre and offering you this 2.75 % offer on their own...very weird.

Even SOME of those who are already on 2.5 % promo are getting these calls, they are basically over riding your existing 2.5 % promo & giving you 2.75 %

10:21 pm

June 15, 2016

Offline

OfflineMy dad has 2.5 % on NEW balance till May 31. ALL the money in his account is NEW deposit money as he had emptied his account prior to this 2.5 % offer that was made to him. So whether its new money or entire balance for 2.5 % its pretty much same to him as his snap shot was $ 0.

He called in to get the 2.75 % as its just 0.25 % more than what he is getting right now anyway.

The rep came back with a 2 % for 180 days offer..LOL. My dad told him he already has 2.5 % till May 31 so 2 % is a downgrade for him, so why in hell will he go for that as 2 % starts immediately and over rides his current 2.5 %.

The rep kept on insisting that's the best offer and on ENTIRE balance and his current 2.5 % is just on NEW deposits..LOL..so he should take 2 % ..ha ha.

My dad explained to him ALL his money is NEW money so 2.5 % gets applied to the ENTIRE balance anyway, so he will get 0.5 % less if he takes the 2 % offer.

The rep wouldn't budge, forget 2.75 % , she wouldn't even extend the current 2.5 % either and want to downgrade it to 2 % for 180 days

He is seriously thinking of DUCA Financial - 3.15 % or Meridian Credit Union - 3 % now , after this Tangerine shenanigans.

So from 2.5 % if you want to go up to 2.75 % they basically want you to go down to 2 %

5:02 am

December 17, 2016

Offline

OfflineYour battle may not be over - read THIS thread

9:50 pm

April 2, 2015

Offline

OfflineI got this call in the morning for the 2.75% promo with a representative. I warned him I'd be going into underground parking and would likely lose the connection. He said he'd put a note on my account for when I call back. Unfortunately, I was busy at work and didn't call back until I got home. When I called in, the service representative read the note which said to forward my call to the initial caller, however, I was told that person was already done for the day. Guess I'll have to follow up tomorrow morning.

2:33 am

February 27, 2018

Offline

OfflineIn one of my earlier rants, i speculated why a financial institution would offer higher investment/savings rates and right now, Tangerine seem to be tripping over themselves. This reeks of both desperation and perspiration. How many billions of dollars are they preparing to write off? Are their mortgage and auto loan defaults about increase? Maybe a bad investment? "Damn, we shouldn't have bought so much bitcoin and facebook" You tell me, ever heard of a bank calling someone at home, calling someone at work? "Please..... let us give you a better savings rate. No problem sir/madam, we will call you back, what time is more accommodating to you"?

5:51 am

October 22, 2015

Offline

OfflineSo is the reason they are calling people as opposed to email is so that no one has written proof of their nonsensical lottery banking?

I told them to shove it a couple of years ago, when three offers in a row, offered me, the crappiest rate on all three. No amount of calling, letter writing or begging got me anywhere.

They are horrible, dishonest weasels.

6:17 am

April 7, 2016

Offline

Offline8:11 am

October 21, 2013

Offline

OfflineI have to agree with Kidd that it's a strange way of operating. It's also an about-face for Tang in particular, as they normally play hard-to-get, wherein you have to log in and go on a treasure hunt to find where they have posted the offer (if any), or wait on the phone for a half hour or so to ask or beg, depending.

They are, it seems to me, messing with their "brand". I'm no marketer but I think a brand ought to offer more consistency than these folks give us. If your brand is "lottery", well, good luck to you, but I think it's only dividing your customers into lovers and haters.

If I received one of these calls, which I haven't, and don't expect I will, my first reaction would be suspicion. How do I know it's really Tang that is calling me? Might be someone phishing for more info about me etc.

And, if you want to give me more money, great, but there is actually no need to phone me at all. Just give it to me, and send me a letter to that effect. I guess they think the "personal touch", the sound of their underpaid voices, will make a difference, but, to me, it would be a nuisance call, ESPECIALLY if i got called at work.

10:32 am

June 15, 2016

Offline

OfflineBanks keep on telling us don't give your PIN over the phone to anyone due to all the scam calls and phising scams.

Now Tangerine themselves are calling and asking for the same..LOL. Its so easy to spoof numbers on Caller ID that its hard to tell if its a legit call or not.

Why not just call or send you an email saying log into your account, you have an offer waiting.

10:34 am

June 15, 2016

Offline

Offlinethreeoakwest said

I'm in the process of leaving them, after being there for many, many, years back to ING. I will also be cancelling my Tangerine Credit Card. They refused me the 2.75% and offered me 1.6%. Wow!

Moved everything but a few dollars out to Hubert and EQ.

My dad already has 2.5 % till May 31, he called in to get 2.75 % and they offered him 2 % for 180 days..LOL.

So basically going down from 2.5 % to 2 % is considered to be a promo..ha ha.

1:56 pm

July 10, 2011

Offline

Offline3:55 am

September 11, 2013

Offline

OfflineSo can we say the "move your money out before the end of a quarter and then wait for a promo offer a few into the next quarter" technique is history? I haven't followed everything on here but from what I have read it seems Tangerine might have abandoned that marketing tactic, at least this quarter - ?

7:14 am

November 7, 2014

Offline

Offline9:33 am

October 5, 2017

Offline

OfflineTangerine Marketing department called me this morning and offered me 2.75 % for 270 days.

Don't know why I was selected but I said yes to the new rate.

A better rate for additional 6 months no strings attached.

I was going to move to EQ when the current promo of 2.5% ends in June

Wonder what will this rate do to other FI's trying to attract money ?

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.