Topic RSS

Topic RSS

12:10 pm

August 4, 2010

Offline

Offline12:15 pm

September 5, 2013

Offline

Offline12:17 pm

April 24, 2017

Offline

OfflineCanaccord Genuity Wealth Management Announcement

I felt the need to put this text in bold caps:

"THE PRODUCT REVIEW COMMITTEE HAS DETERMINED THAT TWO OF OUR INVESTMENT SAVINGS ACCOUNT PROVIDERS, HOME TRUST AND EQUITABLE BANK, WILL BE REMOVED FROM OUR PLATFORM DUE TO CERTAIN RISKS ASSOCIATED WITH THEIR BUSINESS"

Canaccord Genuity, a large institution that should have a strong pulse for what is happening in the Canadian financial markets, has decided that it has a fiduciary duty to prevent its clients from parking money at Home Capital Group.

12:20 pm

September 5, 2013

Offline

Offline12:28 pm

September 5, 2013

Offline

Offline12:41 pm

September 5, 2013

Offline

OfflineThere is nothing wrong with share buy-back and well publicized on TSX and company websites.

http://www.homecapital.com/pre.....0final.pdf

Please make sure you understand this was the offer to existing shareholders only.

Too bad, you could not short during that time, because you didn't have shares.

1:47 pm

August 4, 2010

Offline

Offline

For the non-under-a-bridge-waiting-for-three-goats contingent, a note that "brokered deposits" may mean something like this, where a single entity is placing a large amount with a bank, and selling it off in pieces, or otherwise acting as a single chokepoint for decisions. GIC brokers, or GICs sold through stockbrokers, are not that; each investor is making a separate decision as to where their money goes. Home distinguishes GIC sales through their own Oaken brand vs those sold through the brokerage channels, but they are all individual retail deposits.

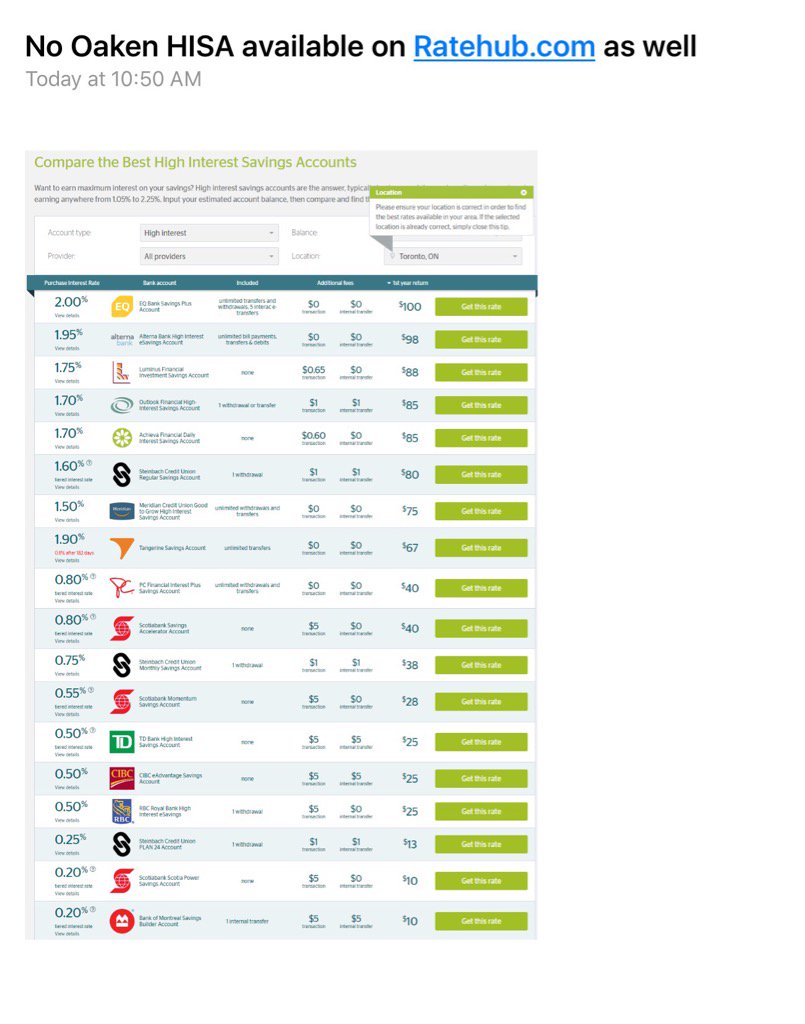

If Home is locked out of a bunch of the Big5 brokerage channels, that would be bad, but it looks like they are staying there (with $100K caps). It looks like they are back on RateHub as well. Move along, nothing to see here... 🙂

2:54 pm

April 22, 2017

Offline

OfflineNorthernRaven said

For the non-under-a-bridge-waiting-for-three-goats contingent, a note that "brokered deposits" may mean something like this, where a single entity is placing a large amount with a bank, and selling it off in pieces, or otherwise acting as a single chokepoint for decisions. GIC brokers, or GICs sold through stockbrokers, are not that; each investor is making a separate decision as to where their money goes. Home distinguishes GIC sales through their own Oaken brand vs those sold through the brokerage channels, but they are all individual retail deposits.

If Home is locked out of a bunch of the Big5 brokerage channels, that would be bad, but it looks like they are staying there (with $100K caps). It looks like they are back on RateHub as well. Move along, nothing to see here... 🙂

There's been identical posts across a variety of different investing message boards. I'm surprised the trolling has even reached a GIC forum. Looks like the shorts are going so far as to deliberate trying to stoke fear in depositors and spark a run on the bank.

For those worried about Home's viability - consider that their mortgage arrears rate is at 0.24%. The company remains highly profitable with a ton of excess capital.

But anyway, that's beside the point. Their deposits are insured by CDIC.

5:05 pm

April 6, 2013

Offline

OfflineDr_Hubert said

Hi Brimleychen, you must be a very brave man.

Brimleychen may be brave. But, he doesn't need to be.

Canadian GIC's don't work the same as American Certificates of Deposit (American CD's).

A five-year American CD is usually cashable before maturity, with a penalty. In contrast, a five-year Canadian GIC is usually not cashable until maturity, except maybe in the case the depositor dies.

So, those brokered GIC's and those Oaken GIC's cannot "walk out the door" any time except at maturity.

Guess whoever wrote that malarkey didn't realize that Home Capital Group, Home Trust, and Home Bank are all in Canada and not the US.

5:29 pm

December 17, 2016

Offline

OfflineNorman1 said

... a five-year Canadian GIC is usually not cashable until maturity, except maybe in the case the depositor dies.

For the record, Outlook Financial ONLY offers "cashable" GICs, with the following conditions -

WHY OUTLOOK CASHABLE GICS?

In addition to the guaranteed interest rates of GICs, Outlook GICs offer these other advantages.

Unlike many other financial institutions, Outlook GICs are guaranteed without limit for 100% of the deposit and interest, so your investments are worry-free.

Choose from 1 to 5 year GICs with Outlook’s great rates – higher than most conventional financial institutions.

You can withdraw from your GIC at any time, so you’re secure in knowing you have the money if you really need it. The minimum withdrawal amount is $1000. You must maintain a minimum balance of $1000, or you have the option to cash your entire GIC at the early withdrawal rate. Withdrawals from Cashable GICs made prior to the maturity date will earn the early-withdrawal interest rate on the funds withdrawn, calculated back to the date of deposit. The remainder of the GIC will continue to earn its regular rate of interest.

7:04 pm

December 12, 2015

Offline

Offline9:05 pm

October 21, 2013

Offline

Offline2:09 am

December 12, 2015

Offline

OfflineTwo articles on HCG. The second explains a "short squeeze" and why shorters are themselves at big risk now of losing money on HCG.

2:45 am

December 12, 2015

Offline

Offline6:23 am

September 5, 2013

Offline

OfflineHome Trust is safe now.

Home Capital Announces Non-Binding Agreement in Principle with Major Institutional Investor for Credit Line of $2 Billion

6:45 am

August 4, 2010

Offline

Offline7:21 am

December 17, 2016

Offline

OfflineBrimleychen said

Home Trust is safe now.

NorthernRaven said

Actually, there's apparently a $100 million fee, and 10% interest on drawn funds ($1 billion initial draw) and 2.5% on standby (the other billion), so this is a very costly funding lifeline.

Hmmmm, I'm no longer sure where this story might be headed

http://www.theglobeandmail.com.....e34816524/

http://business.financialpost......ts-decline

But I am sure the CDIC is all over this.

8:21 am

April 7, 2017

Offline

OfflineJust from my point of view. Oaken, Home Trust has had so much negative publicity over the years I just can no longer support them or any other FI with the word trust in their name like Peoples Trust.

Their share price is down by 59% and high interest savings account balances at Home Trust have fallen by $591 million in the period from March 28 to April 24 which is a reflection of non confidence.

I am sure there is a technical reason why some FI's have the word "trust" in their name BUT I am prepared to stay away from any FI that uses "trust" in their name or any of their slogans. The word trust can refer to "reliance on the integrity, strength, ability, surety, etc., of a person or thing; confidence", which in the case of Home Trust (Oaken) is very misleading.

Here is a another misleading, to me, slogan from another FI "strong reliable trustworthy forward-thinking". So far nothing like that has happened for my investments!!

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.