Topic RSS

Topic RSS

5:58 am

December 20, 2019

Offline

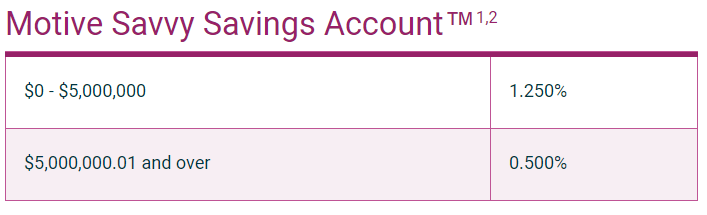

OfflineMotive Savvy Savings has been one of the leaders for a long time. They took a little dip the past few months but all in all it has been a solid savings account.

When I first opened an account there the interest rate was higher than anyone else but they toped out at one million and anything over virtually made no interest.

That changed about a year back when they took off the restrictions and all your deposits earned the same interest, even the part over one million.

When I checked today it was changed and restrictions are back on but they are set at five million.

Now that most everyone is back down to 1.25% I have moved my funds from CTF back to motive because they have more services, checks etc.

May try saven financial because they are at 1.55% but I fear by the time I open an account there they will probably also be at 1.25%

12:35 pm

December 18, 2008

Offline

Offline12:41 pm

December 20, 2019

Offline

OfflineNope, I even called in and since I started dealing with them..

1. Was originally capped at 1 million

2. Cap was removed

3. Cap back at 5 million

I remember because I was not able to put in more than one million without taking a big interest rate cut. I was excited when they removed it and the only reason I saw the cap again yesterday is because I moved a chunk of money from Canadian Tire back to Motive. Something told me to quickly check and then I saw the 5 million cap.

I have only ever had the savvy savings so that is what I was always looking at.

6:57 pm

December 20, 2019

Offline

OfflineMG said

Well since Kam is draining all his huge balances out of Canadian Tire Bank, maybe they will need more deposits and raise their rates back up to attract some more dollars. Wouldn't that be nice?

I really did not like having funds sitting there, I deal with so many banks (to limit my exposure) and that one has to be one of the most antiquated.

The only three things that bank had going for it were..

1. Interest Rate

2. No Cap on deposits, all funds get same rate

3. You can push out as much money as you want without having to call in

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.