Topic RSS

Topic RSS

9:52 pm

December 26, 2018

Offline

OfflineEdit by admin: the promotional rate refers to an expired promotion. See this other thread to discuss the new promo for group benefits users.

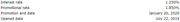

When I open my account below rates were showing..

Interest rate 1.500%

Promotional rate 1.850%

Today below rates are showing

Interest rate 1.250%

Promotional rate 1.850%

I will give them a call tomorrow morning to find out what's going on. I do have a screen shot of old rates.

Anyone else got affected

12:56 am

April 9, 2013

Offline

OfflineGood catch!

My acc't shows the same, but surprisingly, my wife's acc't now no longer shows the promo rate. On the other hand, the rates page still shows 1.50%.

I don't know what they're up to, but maybe they're selectively cancelling the deal for certain accountholders.

According to the T&C, they can pretty much do whatever they want, but if this isn't a glitch, they're gonna get lambasted & I'd suggest others affected do likewise.

5:39 am

April 6, 2013

Online

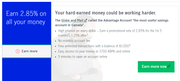

OnlineThe Advantage Account page now shows a lower regular rate of 1.25%.

Looks like you had an early glimpse of their rate drop.

5:44 am

December 7, 2018

Offline

Offline6:06 am

December 26, 2018

Offline

OfflineNorman1 said

The Advantage Account page now shows a lower regular rate of 1.25%.Looks like you had an early glimpse of their rate drop.

It is still better then What I was getting.

8:29 am

December 12, 2009

Offline

OfflineInteresting! When they decrease rates, they don't adjust their promotional rate correspondingly upwards. Tangerine (and others), meanwhile, when regular rates increase, adjusts downward the promotional rate by an amount commensurate with the regular rate increase. In short, we get screwed both ways. 😉

This is one of the main reasons why I don't play these promo games anyway for a measily 25-50 bps. Best bet, I figure, is to lock in with the highest GIC rate you can get or accept a lower HISA rate. Life's also too short.

Cheers,

Doug

9:36 am

July 21, 2019

Offline

OfflineMy funds were in there literally for 10 hours and the rates changed

I posted in the original topic

https://www.highinterestsavings.ca/forum/manulife-bank/3-35-for-6-months-new-acounts-promotion-advantage-account/page-12/#p42821

I won't touch them again

9:37 am

December 12, 2009

Offline

Offlinetheodor said

I thought the rates were guaranteed for 6 months, am I wrong?Ted

"Guaranteed" (like a GIC)? No. Promotion end date is in 6 months? Yes.

They're sneaky. They have all kinds of explicit and implicit language, such as provisions that allow them to vary the terms at any time without notice for any reason (including the early withdrawal of the promotion).

Hope that helps,

Doug

10:13 am

November 4, 2015

Offline

OfflineHi again,

just spoke with a Manulife rep and was assured that the 0.25% reduction in their regular interest rate would be added to the promo rate. When I signed up the regular interest rate was 1.5% and the promo rate was 1.85%. I was assured that my promo rate would be adjusted upwards to 2.1% for the duration of the 6 months term. When I asked if this was confirmed anywhere on their website I was told no, but that the interest paid monthly would reflect the promised rate. I guess we will have to wait until August 1, 2019 to confirm but the impression I got from my conversation with the rep leads me to believe that Manulife will honor their promise.

10:29 am

July 21, 2019

Offline

Offlinetheodor said

Hi again,

just spoke with a Manulife rep and was assured that the 0.25% reduction in their regular interest rate would be added to the promo rate. When I signed up the regular interest rate was 1.5% and the promo rate was 1.85%. I was assured that my promo rate would be adjusted upwards to 2.1% for the duration of the 6 months term. When I asked if this was confirmed anywhere on their website I was told no, but that the interest paid monthly would reflect the promised rate. I guess we will have to wait until August 1, 2019 to confirm but the impression I got from my conversation with the rep leads me to believe that Manulife will honor their promise.

Not sure if I believe that, it's pretty clear on my account page.

10:41 am

July 21, 2019

Offline

OfflineHere is also why I don't believe it

https://www.manulifebank.ca/campaign/groupoffers/gb-flexible-financial-solutions.html#advantage

11:00 am

July 21, 2019

Offline

OfflineI just phoned Manulife and spent 15 minutes talking with the agent.

I told her it's seems very odd that I opened my account when the limit was 500k, then they reduce it to 100k. Literally at midnight my 100k goes in and a few hours later the rate goes down.

So I asked he specifically what @theodor mentioned. She said he is absolutely wrong and as per the terms of this promotion the base rate will fluctuate and there will be NO compensation back up to the old base of 1.50%

So there you have it from the horses mouth.

I guarantee this was done on purpose, collect as much funds as possible and then quickly and quietly lower the rate.

I tried to transfer out but the funds are on hold for 5 days. Now I have to file a stupid T4 for a weeks interest.... double blaaah

11:22 am

December 12, 2009

Offline

OfflineMapleOne said

Here is also why I don't believe ithttps://www.manulifebank.ca/campaign/groupoffers/gb-flexible-financial-solutions.html#advantage

Thanks for sharing these, MapleOne.

I hadn't heard of "postimage.cc," but seems like a good quick, forum image hosting service. In case you didn't know, Peter allows us to upload images directly using "upload attachments" on this forum. There's no cumulative upload limit, as far as I'm aware, and I'm not sure what the specific file upload limit is.

Based on what you've shared and my own experience with Tangerine, I'm inclined to think the Manulife Bank CSR with whom @theodor spoke was either (a) misguided, (b) was speaking based on assumptions and logical presumptions, or (c) was correct at the time, but Manulife Bank has since changed their stance with respect to promo interest rate changes (which the T&C state they can do, for better or for worse). It's one of the reason I'm tired of these promo rate games.

The Advantage account is still a good no-fee chequing and savings account for all your day-to-day banking, if you keep $1,000 in it, all transaction fees are waived and there's no monthly fee whether you keep $1,000 in it or not (just per-transaction fees, except on pre-authorized debits and ATM cash withdrawals, which are always free). Would I sign up for it? Probably not, at least not in its current form.

I think you made a wise choice in choosing Motive's Savvy Savings Account and Tangerine's special promotional rate for you.

Cheers,

Doug

11:33 am

July 21, 2019

Offline

Offline@Doug

I had uploaded a couple of images (in a different topic) and they were too small to read and for some reason not clickable. I have been using postimage.cc for years and its all free and it saves your images if you login. I like that it gives you the bb code for forums immediately.

When I owned a large forum I actually hardcoded postimage.cc and used it instead of the upload function to save on server costs.

As far as Tangerine and Motive goes, I use them because they both have high limits. I also use motus but they only allow one million across all accounts and since I have 7 accounts there it filled up pretty fast.

4:06 pm

February 6, 2019

Online

OnlineIt is pretty bad that ManulifeBank has dropped the rate, and not by .1% at a time, but .25% overnight, however at 3.1% (or 3%) it is still the best HISA rate that I am aware of, as of now.

What this means is that I am not moving out my savings ... yet. That will most likely happen next time when they drop rates.

4:24 pm

December 12, 2009

Offline

Offlinerk said

It is pretty bad that ManulifeBank has dropped the rate, and not by .1% at a time, but .25% overnight, however at 3.1% (or 3%) it is still the best HISA rate that I am aware of, as of now.

What this means is that I am not moving out my savings ... yet. That will most likely happen next time when they drop rates.

Agree, @rk, that it makes sense, if you're already there and have been since the beginning of the promotion, to keep your money there.

Cheers,

Doug

5:06 pm

February 6, 2019

Online

OnlineDoug said

Agree, @rk, that it makes sense, if you're already there and have been since the beginning of the promotion, to keep your money there.

Not quite from the beginning, only for 6 weeks or so. And it was hard work to set it up (took one week, several emails and phone calls, even had to be creative to setup the link with another FI, etc...). But this does not mean that I will not move all my money out if-when they will no longer be #1 in terms of rates.

9:31 pm

December 26, 2018

Offline

Offlinerk said

Doug said

Agree, @rk, that it makes sense, if you're already there and have been since the beginning of the promotion, to keep your money there.Not quite from the beginning, only for 6 weeks or so. And it was hard work to set it up (took one week, several emails and phone calls, even had to be creative to setup the link with another FI, etc...). But this does not mean that I will not move all my money out if-when they will no longer be #1 in terms of rates.

I am surprised with your experience. My account was open and active within 10 minutes on Tuesday. Link with another FI's were completed on Wednesday. All funds that I transferred on Wednesday already showing in my account.

5:19 am

February 6, 2019

Online

OnlineCanadianbull said

I am surprised with your experience. My account was open and active within 10 minutes on Tuesday. Link with another FI's were completed on Wednesday. All funds that I transferred on Wednesday already showing in my account.

My experience was detailed at the time in a different thread. Long story short, my account is joint and I wanted to link it to an external FI for which I did not have cheques. Although I did exactly what the CSR asked me to on the phone - twice - they have never linked it. The workaround was to link my Manulife account from the other FI. So, instead of a pull, I had to do a push. I had no issue with transferring funds, either. Sometimes the transfer shows up during the same day, which is remarkable.

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.