Topic RSS

Topic RSS

3:43 pm

February 6, 2019

Offline

OfflineAlthough I was not able to link an external account for which I do not have cheques (see my previous posts) , I was able to do it the other way around. I linked my Manulife account from the other FI (using a downloaded void cheque from Manulife). Therefore, I was able to transfer. Instead of a pull from Manulife, I had to do a push from the other FI. That's OK, eventually it worked out. I did the push in the morning and I saw the amount in my Manulife account in the evening, same day. That is fast.

9:50 am

May 25, 2019

Offline

OfflineWhen I'm in the process of signing in at Manulifebank I see that i get in right away. Contrary to all institutions i've used so far (banks+CUs), here there's no security question ("who was the best friend of your great grandmother when she was at school"), no image/and or secret phrase meaning "ok you're safe here you're on the authentic website", no safety code to got get immediatly in my email account, nothing except my password. I don't know what to think about this, I mean: I'm left with this question, do these guys protect enough the "gates" of their online "vault"? Any opinion on that among you HIS.ca members? Ty. Otherwise everything is ok with my Manuvie experience: No problem so far with creating a link (used void cheque) or transferring money in and out. (Also I like the fact that, if for some reason I wouldn't have access to Internet, I still can call Manulife and ask the rep verbally to do the transfer for me.)

8:42 pm

September 29, 2017

Offline

OfflineJust an update on my migration.... the original set-up was VERY easy and went VERY smoothly...or so I thought.

After performing 4 transfers in for almost $200K AND having my Manulife Advisor add his name to my accounts (to get a preferential rate of +0.25% to the base rate), two external accounts were linked. with RBC and Meridian, using VOID cheques with all the pertinent info.

IN spite of all that, I was eventually told I still needed to send in a cheque for at least $1 with my signature. I received conflicting info regarding this given all the above. It did not go well around that issue, with agents giving me rote replies and not taking into account anything that had transpired or was said. Very frustating not being able to get clear answers and outside the box thinking.

Has left me with a pretty sour taste over the whole ordeal. Time will tell how the rest of this relationship will play out.

9:46 pm

April 6, 2013

Offline

Offlinesmayer97 said

…

IN spite of all that, I was eventually told I still needed to send in a cheque for at least $1 with my signature. I received conflicting info regarding this given all the above. It did not go well around that issue, with agents giving me rote replies and not taking into account anything that had transpired or was said. Very frustating not being able to get clear answers and outside the box thinking.

…

Without a signed cheque drawn on one of the client's existing chequing accounts that clears, how would Manulife Bank obtain an authoritative specimen of the client's handwritten signature?

A signature specimen is needed as the Advantage Account is a chequing account that one could write cheques on. I don't think a Canadian credit bureau record includes the person's signature.

9:56 pm

September 29, 2017

Offline

OfflineNorman1 said

smayer97 said

…

IN spite of all that, I was eventually told I still needed to send in a cheque for at least $1 with my signature. I received conflicting info regarding this given all the above. It did not go well around that issue, with agents giving me rote replies and not taking into account anything that had transpired or was said. Very frustating not being able to get clear answers and outside the box thinking.

…Without a signed cheque drawn on one of the client's existing chequing accounts that clears, how would Manulife Bank obtain an authoritative specimen of the client's handwritten signature?

A signature specimen is needed as the Advantage Account is a chequing account that one could write cheques on. I don't think a Canadian credit bureau record includes the person's signature.

Thanks. First, I did not realize that this account has chequing capability. AFAIR it was promoted as a high interest SAVINGS account. Second, the problem is that several agents never communicated that or any related requirement AND contradicted each other, both on the phone and via e-mail. So a lot of time was wasted back and forth trying to get clarity. You would think that agents should be able to articulate the bank's requirements and for what purpose.

5:00 am

December 20, 2016

Offline

Offlinesmayer97 said

.... several agents never communicated that or any related requirement AND contradicted each other, both on the phone and via e-mail. ....... You would think that agents should be able to articulate the bank's requirements and for what purpose.

Contradictory information from Manulife Bank CSR's seems to be a recurring theme from the experiences of many applicants for Advantage accounts, myself included. They need to consolidate their training and more closely monitor the performance of their front line personnel, in my view.

Stephen

10:48 am

October 21, 2013

Offline

OfflineNorman1 said

smayer97 said

…

IN spite of all that, I was eventually told I still needed to send in a cheque for at least $1 with my signature. I received conflicting info regarding this given all the above. It did not go well around that issue, with agents giving me rote replies and not taking into account anything that had transpired or was said. Very frustating not being able to get clear answers and outside the box thinking.

…Without a signed cheque drawn on one of the client's existing chequing accounts that clears, how would Manulife Bank obtain an authoritative specimen of the client's handwritten signature?

A signature specimen is needed as the Advantage Account is a chequing account that one could write cheques on. I don't think a Canadian credit bureau record includes the person's signature.

When you sign up with motus for a savings account, they require and accept your signature done online using mouse or whatever to write it on the screen - similar to signing for a courier package on a screen. I don't know if their chequing account works the same way, but probably. I should find that out soon.

I was not too keen on this system as I find it hard to write normally this way.

6:28 pm

July 21, 2019

Offline

OfflineGood said

Manulife has lowered the maximum deposit to 100,000 for those who open up a account after June 18,19.Accounts opened before that date can receive 3.25% interest on deposits up to 500,000.

Just spoke to a representative

I can confirm this....

Crap, I thought I hit a gold mine there at 500k

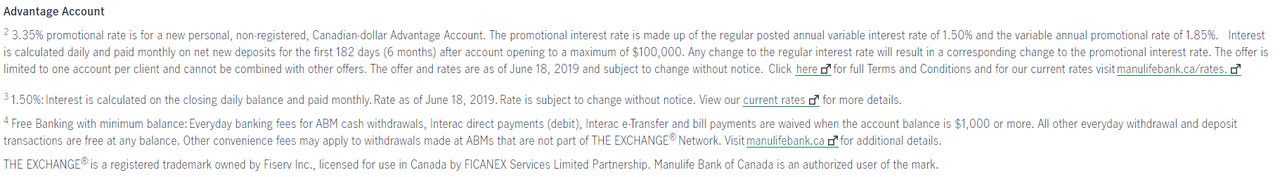

Advantage Account

2 3.35% promotional rate is for a new personal, non-registered, Canadian-dollar Advantage Account. The promotional interest rate is made up of the regular posted annual variable interest rate of 1.50% and the variable annual promotional rate of 1.85%. Interest is calculated daily and paid monthly on net new deposits for the first 182 days (6 months) after account opening to a maximum of $100,000. Any change to the regular interest rate will result in a corresponding change to the promotional interest rate. The offer is limited to one account per client and cannot be combined with other offers. The offer and rates are as of June 18, 2019 and subject to change without notice. Click here for full Terms and Conditions and for our current rates visit manulifebank.ca/rates.

3 1.50%: Interest is calculated on the closing daily balance and paid monthly. Rate as of June 18, 2019. Rate is subject to change without notice. View our current rates for more details.

4 Free Banking with minimum balance: Everyday banking fees for ABM cash withdrawals, Interac direct payments (debit), Interac e-Transfer and bill payments are waived when the account balance is $1,000 or more. All other everyday withdrawal and deposit transactions are free at any balance. Other convenience fees may apply to withdrawals made at ABMs that are not part of THE EXCHANGE® Network. Visit manulifebank.ca for additional details.

THE EXCHANGE® is a registered trademark owned by Fiserv Inc., licensed for use in Canada by FICANEX Services Limited Partnership. Manulife Bank of Canada is an authorized user of the mark.

6:41 pm

July 21, 2019

Offline

OfflineStupid deal

On 100k it pays out $200 for 6 months than Motives 2.85%

$1625 instead of $1425

Does not seem worth it especially because you can put a million into the Motive deal.

I opened an account at Motive and saw the post from @good afterwards.

I wish I would have simply ignored this deal, especially because they did a hard credit hit.

5:47 am

July 21, 2019

Offline

OfflineThe manulife offer is still good only the limit has been reduced

https://www.manulifebank.ca/campaign/groupoffers/gb-flexible-financial-solutions.html#advantage

11:40 pm

October 21, 2013

Offline

OfflineIf you click on the link MapleOne has indicated, then click on the "earn more" and then on "earn more now" on the following page, finally you get the page that includes a sign-up. Look at the bottom of that sign-up page in the green area where there is, near the end, a link to the Terms and Conditions of the offer. https://repsourcepublic.manulife.com/wps/wcm/connect/b092aec4-472f-4877-88d3-9b638ce1c4ca/bnk_adv_dgbw2019offerterms.pdf?MOD=AJPERES&CACHEID=ROOTWORKSPACE-b092aec4-472f-4877-88d3-9b638ce1c4ca-mJEk1p1

Terms and Conditions make it very clear in the first paragraph that you had to have had an account set up by July 15 in order to qualify for this offer.

Hence it is not an active offer for new sign-ups. Rather, the teaser ad should have been taken down.

If anyone has any more promising info, please post where you find this.

(I am not personally interested in this offer as I don't want to deal with ManuLife Bank. I'm just trying to clarify for others.)

12:00 am

December 26, 2018

Offline

Offline2:19 am

October 21, 2013

Offline

OfflineCanadianbull said

Hi Loonie,Below is showing under my new account details. If I do not qualify why would they mention promotion rate under my new account details?

Interest rate 1.500%

Promotional rate 1.850%

Promotion end date January 21, 2020

Opened date July 23, 2019

Interesting. I don't know how this has occurred. I would keep an eye on it in case the computer changes its "mind" later.

Take a copy of this in case you need it for evidence!

For anyone else considering this offer, I suggest making a phone call first. If they agree that you can still have the 3.25%, then ask them to email you a copy of the offer &/or show you exactly where it is on the internet. Keep a copy.

Yet another bank with contradictory messages?

5:53 am

December 26, 2018

Offline

Offline6:19 am

December 26, 2018

Offline

Offline1:51 pm

December 26, 2018

Offline

Offline5:16 pm

September 29, 2017

Offline

OfflineInteresting bit of news:

now into second payment of interest and have discovered that Manulife does NOT pay interest on interest earned for the promotional part of the interest, in other words, no compounding. Again, this seems to only apply to the promotional part of the interest rate.

I have been in communication back and forth with them for clarification because as I read the wording, this feels like a bait-and-switch, because the wording in the T&C's does not make this clear at all. In fact the language as I read it uses standard terminology that suggests the standard interpretation, which means earning interest on interest deposits (Manulife claims that promotional interest deposits are not "eligible deposits" but nowhere do they define this in this way).

Has anyone else realize this? Any thoughts or insights on this? If you disagree with Manulife, I encourage you to join in and raise a voice over this issue with them.

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.