Topic RSS

Topic RSS

8:48 pm

April 6, 2013

Offline

OfflineLoonie said

I'm not sure I follow you.

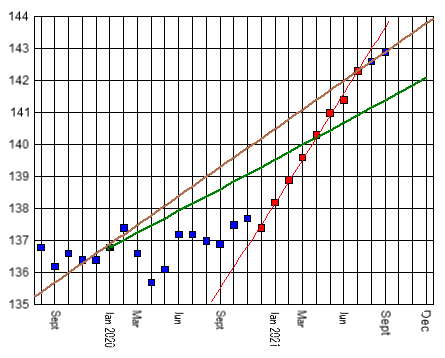

What I see is a steadily increasing divergence between target green line and red line.

That's expected as the price of the CPI basket will diverge between having 2% inflation and having 6% inflation.

Inflation is reflected in the slopes of the lines. Steeper line means higher inflation.

CPI prices were climbing along the steep red 6% per annum inflation line until July. After that, they climbed along the more-moderate 2.6% inflation brown line.

The green 2% line shows prices had they climbed 2% per annum from January 2020.

The red and blue squares are the CPI basket prices from Statistics Canada.

Norman1 said

10:02 pm

April 27, 2017

Offline

OfflinePicking random dates and drawing lines between them can generate any result you are looking for.

Year-over-year change in CPI is a standard way to measure inflation. Went from 4.1% in August to 4.4% in September.

What’s more, CPI is a lagging indicator. Firstly, a lot of fuel-related increases are not showing (not just fuel but everything higher costs of fuel will impact). Secondly, if rents go up it takes a long time to capture because people don’t renew every month. And so on.

Last but not least, inflation has been showing through shortages, which seem to be spreading, and thats not captured by CPI at all.

Inflation is increasing.

10:37 pm

October 29, 2017

Offline

Offlinemordko said

Picking random dates and drawing lines between them can generate any result you are looking for.Year-over-year change in CPI is a standard way to measure inflation. Went from 4.1% in August to 4.4% in September.

Inflation is increasing.

Totally agree! The year-over-year is the chosen interval of significance. Inflation is escalating. The graph is simply month-on-month CPI values.

11:30 pm

October 29, 2017

Offline

OfflinePretty sure those lines in the chart represent the future inflation should CPI follow the lines. In other words, had CPI maintained that red line for a total of 24 months consecutive, we would have an inflation value of 6% for a year. The fact that the last two blue dots are on a lesser trajectory only shows price increases are slowing. It doesn’t say anything about inflation because we don’t know what’s coming in a year from now. Prices aren’t rising as fast, that’s all you can conclude. It may turn out that next year could be a huge jump from those monthly values and therefore higher inflation. The lines don’t give any indication of current inflation because they are month-on-month. We went over this a long time ago, consecutive monthly CPI values do not determine inflation or deflation.

4:48 am

January 9, 2011

Offline

OfflineI'm also having difficulty in both assessing and drawing conclusions from this.

So I go back to basics. In this month of October, while the price of gas at the pumps went up again, salad dressing went from 2 for $ 4- to 2 for $ 5-. That's up 25%! Cat food went from $ 0.60 to $ 0.70 per can. That's up 16.67%! Just two examples.

"Keep your stick on the ice. Remember, I'm pulling for you. We're all in this together." - Red Green

7:07 am

April 27, 2017

Offline

Offlinedougjp said

I'm also having difficulty in both assessing and drawing conclusions from this.So I go back to basics. In this month of October, while the price of gas at the pumps went up again, salad dressing went from 2 for $ 4- to 2 for $ 5-. That's up 25%! Cat food went from $ 0.60 to $ 0.70 per can. That's up 16.67%! Just two examples.

Eight “groups” in CPI. You are focusing on one out of eight.

Other key groups include “transportation”. Flights are cheaper than a year ago but with the fuel price rocketing, its not for long.

Try to buy a car. Good luck. Inflation numbers not reflected in the price yet but they will be.

Healthcare… That cost is fixed by the government. So inflation can’t show in the cost numbers. We have massive shortages made worse by Covid but its not reflected in CPI.

Housing… As noted above housing costs have jumped but it will take a few years for CPI to start reflecting it.

Recreation. Not sure how CPI is measured for something that has been suppressed.

We also have large pay rises across the west which will be showing in CPI. And election giveaways , specific to Canada. And the consumer used to be resistant to price rises for apparel, etc. No longer the case. A lot of psychological barriers have been broken.

As always, the numbers are useful but only if you understand the meaning rather than merely draw lines between dots. CPI trending is about understanding what hasn’t been captured in September numbers.

7:31 am

October 27, 2013

Offline

OfflineI see too much 'seeing what one wants to see' in the numbers. While it is true YOY inflation numbers are remaining persistently high and there may be indeed be higher inflation (than 2%) staying higher longer than one wants, don't shoot the messenger.

Norman1's graph is showing to some degree what central banks and some have been saying, i.e. the expectation that YOY inflation increases are now beginning to decelerate in magnitude. Others have been articulating similar information in other forums. YOY data is something one must be cognizant of but one does not need to become overly alarmed over, and call EMS just yet.

I will be a lot more interested in the next 3-4 months of YOY data and only if it remains persistently high into next Spring and is not rolling over, will there be real reason to tap on the brakes. The earliest I see interest rate changes is Spring of 2022 when it will be more apparent if some of the heat needs to be taken out.

Added: I do agree CPI is a lagging indicator and one cannot let the horse run loose too long but it is not clear the horse is running yet in full stride.

7:32 am

April 6, 2013

Offline

Offlinedougjp said

I'm also having difficulty in both assessing and drawing conclusions from this.So I go back to basics. In this month of October, while the price of gas at the pumps went up again, salad dressing went from 2 for $ 4- to 2 for $ 5-. That's up 25%! Cat food went from $ 0.60 to $ 0.70 per can. That's up 16.67%! Just two examples.

It is too early for this month's price changes. What Statistics Canada released recently is the Consumer Price Index data for September. We will have to wait until next month to see what the Consumer Price Index data for this month is.

Not everything changes price by the same amount. Consumer Price Index is also a blended average. Kind of like the total cost of an "average" hamburger. If the ground beef goes up by 15¢ but the onions drops by 14¢, the cost of the "average" burger has only gone up by 1¢.

The challenge is that for those who don't put onions in their burger, the cost of their burger actually went up by 15¢ and not the 1¢ of the "average" burger.

Statistics Canada does publish detailed price subindex data for those who want to calculate their own personal inflation rate.

8:57 am

April 6, 2013

Offline

OfflineAltaRed said

I see too much 'seeing what one wants to see' in the numbers. While it is true YOY inflation numbers are remaining persistently high and there may be indeed be higher inflation (than 2%) staying higher longer than one wants, don't shoot the messenger.Norman1's graph is showing to some degree what central banks and some have been saying, i.e. the expectation that YOY inflation increases are now beginning to decelerate in magnitude. Others have been articulating similar information in other forums. YOY data is something one must be cognizant of but one does not need to become overly alarmed over, and call EMS just yet.

…

I agree.

Stay fixated on the year-over-year numbers and be months behind what's actually happening.

With year-over-year CPI rate, one has already missed prices climbing around 6% per annum for months now. People spending on goods and services have not.

If the current tread holds for a few more months, one will also miss the moderating of inflation to 2.6%.

Just like using the hour-over-hour distance covered for a car. One will miss the dangerous driver who has been whizzing through the streets at 150 km/h for the past 10 minutes. After all, the hour-over-hour distance traveled indicates a speed of only 25 km/h as he was parked for the first 50 minutes of the hour.

24 months on the red 6% line is not needed for 6% year over year inflation. Only 12 months.

CPI for December 2020's on the red line. Should CPI December 2021 also end up on the red line, then the red 6% line will join the two data points and the calculated year-over-year inflation will be 6%.

9:37 am

October 29, 2017

Offline

OfflineIn other words, Norman1 wants inflation to be calculated month-on-month. It may be a different way to perceive inflation, but it’s confusing forum members as to how inflation is interpreted. The 6% does not mean inflation is 6%, it means the future trajectory, should the line be followed, will be 6% inflation. Norman1 is contradicting himself in saying the two blue dots “looks promising” and yet also states that a red dot for December would be 6%. Yes it would be 6%, but you are saying it looks promising that the CPI shows not following the red line. It’s confusing people and it’s a waste of time to guess the future. Inflation is not decelerating because of those two blue dots. The future isn’t set yet and therefore the lower trajectory means nothing.

10:06 am

April 27, 2017

Offline

OfflineStay fixated on the year-over-year numbers and be months behind what's actually happening.

You are always months behind when you are looking at published CPI data. It tells us history. What’s happening today will impact CPI in the future, many months later.

Central Banks are supposed to act before inflation runs hot. They are supposed to be looking at the underlying data, money supply, cost of labour, etc rather than CPI. CPI, once published, tells us if they were right or wrong.

The major risk is that central banks after years of prudence are undermining their credibility. Once that happens, takes a long time to restore.

Internationally, UK might be raising interest rates very shortly.

Meanwhile Federal Reserve has been cowed by politicians and given ludicrous objectives to achieve world piece, equality and prevent climate change.

Canada is half way, as per usual.

10:59 am

April 6, 2013

Offline

OfflineVatox said

In other words, Norman1 wants inflation to be calculated month-on-month. It may be a different way to perceive inflation, but it’s confusing forum members as to how inflation is interpreted. The 6% does not mean inflation is 6%, it means the future trajectory, should the line be followed, will be 6% inflation. …

It's not confusing if one doesn't bury their head in some incorrect definition of inflation.

One needs to watch CPI month-to-month to see what's happening with inflation. The reason we don't react based on a single month-to-month number is that a change in one month can be just noise and not be sustained the next month.

It's no longer noise when the change is sustained for several consecutive month-to-month periods.

In my dangerous driver example, the hourly speed will show the dangerous driver accelerating as more of the past hour includes the time at 150 km/h. But, the driver has not actually been accelerating. The driver has been whizzing at a steady 150 km/h all along.

That exactly what has been happening in the CPI basket. The price of the basket has been climbing at a remarkably steady 6% per annum from January to July while you and others have been claiming incorrectly that the inflation has been accelerating.

Now, you are continuing to claim that inflation is accelerating even though prices have been climbing at a reduced 2.6% per annum for the past two months.

I don't think you understand what the year-over-year numbers mean and don't mean.

Draw that line between the September 2020 and September 2021 CPI data points which represent the year-over-year statistics. You'll see how poorly the CPI basket prices hug it and consequently how meaningless it is for the period.

12:04 pm

October 29, 2017

Offline

OfflineThe problem is that you are talking a different language. It isn’t wrong, but those that may come here and read your statement that inflation is moderating, it’s feeding them misinformation that conflicts with what the masses are saying and reporting. And that’s bad because you aren’t clarifying your perspective correctly. What you should be saying is that you prefer looking at month to month CPI changes as inflation and deflation. Don’t tell people that inflation is moderating because according to the mainstream view, it’s currently accelerating. It’s not confusing to some of us, but those that don’t know the intricacies are being fed misinformation and then they go and spread that misinformation.

12:10 pm

December 12, 2009

Offline

OfflineVatox said

4.4%. I feel a rate hike coming next week!https://www150.statcan.gc.ca/n1/daily-quotidien/211020/dq211020a-eng.htm

No. There will not be a BoC rate increase, likely, before the April 2022 meeting. This is likely transitory and/or temporary post-COVID-19 movement restriction economic bump. Hitting the brakes too soon would likely bring a hard, and deep, recession.

If I were on the Bank of Canada board, I would not be advising a rate increase before April 2022 and even then, allow a shallow path upward, with subsequent 25 bps hikes in July and October 2022 as well as January 2023.

Cheers,

Doug

12:27 pm

December 12, 2009

Offline

OfflineVatox said

The fact that the last two blue dots are on a lesser trajectory only shows price increases are slowing.

This is a key statement. It's the unknown future path. The Bank of Canada has a lot to consider, not least of which is the potential economic impact of too soon BoC rate increases on homeowners and, crucially, the residential real estate market, which makes up a not insignificant portion of the entire Canadian economy and, by extension, of the inflationary pressures. In other words, one of the key drivers of the inflationary pressures is the soaring cost of housing. Increasing rates too quickly, even at all, in a real estate market whereby the federal government has already dramatically increased the qualification criteria for new buyers will cause the real estate market to seize up and come to a grinding halt. No one will want to sell. An already limited pool of buyers, namely to foreign investors, higher net worth investors, and speculators, will dry up. The entire group of players in the real estate industry, from realtors, property managers, lawyers, accountants, bankers, etc., will have no income, and have to file for employment insurance, in order to make end's meat. In short, an economic calamity.

Do I like that this is the economic reality that is Canada? No, obviously not, but this is the reality Canada created for itself with its focus on being an entirely services-based economy, hollowing its manufacturing base, and shifting its head offices to foreign countries with the sale of many of its largest firms to foreign buyers.

In short, it's complicated, and these are the sort of considerations the BoC has to take into account, GIC and HISA depositors being the absolute last consideration on the minds of BoC governors (if they're even on their minds at all)—and, frankly, this is the way it ought to be. If you're looking for a return on your money, it ought to carry with it some degree of risk. If, on the other hand, you're looking for a risk-free way to park your money, you ought to expect to lose money by way of a loss of purchasing power over the medium and long term.

Cheers,

Doug

12:36 pm

October 29, 2017

Offline

OfflineDoug said

No. There will not be a BoC rate increase, likely, before the April 2022 meeting. This is likely transitory and/or temporary post-COVID-19 movement restriction economic bump. Hitting the brakes too soon would likely bring a hard, and deep, recession.

If I were on the Bank of Canada board, I would not be advising a rate increase before April 2022 and even then, allow a shallow path upward, with subsequent 25 bps hikes in July and October 2022 as well as January 2023.

Cheers,

Doug

That may be their plan and they may totally follow it. But why is April going to be a better time to hike rates? I’m looking at Canadian lifestyles and nature. Debts will only be higher and even more people will be living on the edge. They have to start somewhere and procrastination will just increase the load that is holding them from normalizing. Meanwhile, without stamping out inflation, the 53% of Canadians already on the edge, will fall off the edge.

Inflation will cause far more damage than a 25bps increase will.

I suppose I’m just saying they need to raise rates, but they may indeed just totally hold the line. In the end, we get whatever they decide.

12:45 pm

September 11, 2013

Offline

OfflineExactly, I look at it much the same, Doug, though I don't think the steady and growing stream of newcomers to Canada with money to spend nor foreign buyers will be deterred by higher interest rates so I don't see the economic calamity scenario. There's lots of money in the world and Canada's large cities are #1 on lots of folks' lists.

I do agree BoC is very eager, for political reasons if nothing else, to not upset all those urban voters with large mortgages, and also that savers don't even enter BoC's thoughts, and that that's as it should be.

1:01 pm

October 21, 2013

Offline

OfflineThe interview with the fellow from Scotia that someone posted the other day is worth a close listen. At one point he quickly mentions other factors than covid that are pushing inflation and will ensure it stays with us. I don't even think his list is complete, but at least he understands the issue is bigger than covid.

He (or someone I read recently) noted that BoC generally tends to be a slow responder. It's better for them if things take care of themselves, so they are invested in the idea that inflation issues are temporary and have their fingers crossed in a manner that doesn't really befit number crunchers.

In fairness, I think they are between a rock and a hard place. If they let rates go up, there could be a debt crisis; if they let inflation go up, there could also be a debt crisis. But that dilemma leans towards doing nothing.

1:21 pm

April 27, 2017

Offline

Offlinewhereby the federal government has already dramatically increased the qualification criteria for new buyers

I’ve seen pretty strong evidence that the increase was a) not “dramatic” and b) had no effect.

To top it off the government has promised to introduce massive incentives to buy houses for under 40s.

House prices are not in the CPI. They take a loooong time to indirectly show in CPI.

In short, it's complicated, and these are the sort of considerations the BoC has to take into account,

There is one meaningful objective for BoC rate: to keep inflation on target and preserve value of money. BoC is only responsible for the monetary policy. Everything else, be it “economy” or “housing market” are someone else’s problem.

The worry is that BoC is not on the ball and IS focusing on other things. The “transitory” claims are running hollow. Inflation has repeatedly overshot the target and predictions. If you remember we were originally told “it will only be high for a month or two, in contrast to price drops in March/April 2020”. We are in October. And salaries/energy costs are rising very fast. Shortages seem to be getting more widespread.

Sooner or later BoC will be forced to raise rates by Mr Market. And if its late the rates will have to go up higher than otherwise. And THAT will strangle the economy.

1:43 pm

April 27, 2017

Offline

OfflineOur worst case scenario is that Canada starts resembling Turkey.

Governor Sahap Kavcioglu has said publicly that Turkey’s central bank independently sets policy. Last week the bank said it cut rates in part because inflation pressure is temporary.

Inflation is well into double digits and has been for some time.

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.