Topic RSS

Topic RSS

9:02 am

October 29, 2017

Offline

Offline4.4%. I feel a rate hike coming next week!

https://www150.statcan.gc.ca/n1/daily-quotidien/211020/dq211020a-eng.htm

9:08 am

October 21, 2013

Offline

Offline9:28 am

October 29, 2017

Offline

OfflineLoonie said

Does anyone know if .25 is the minimum increment they can do, or could it be less? That seems to be their standard.Personally, I doubt .25 will make a lot of difference, either to inflation or to interest rates offered to investors.

The 25bps moves or multiple of such, is just a convention. They can do any amount they desire. I suppose the convention keeps it nice and tidy. Quarters and quarterly reporting is a fundamental spacing, so 25bps fits nicely.

9:43 am

September 7, 2018

Offline

OfflineLoonie said

Personally, I doubt .25 will make a lot of difference, either to inflation or to interest rates offered to investors.

For those of us who own RESET Preferred Shares in a diversified portfolio, an increase of 25bps DOES make a difference - these shares are interest sensitive and now doing very well (after a long period of low interest rates) as we now enter an upward trajectory in interest rates.

10:24 am

October 21, 2013

Offline

OfflinePreferred shares are a whole other issue and I'm sure there is a forum somewhere where their risks and possibilities can be more thoroughly discussed.

Some GICs also have "resets". I've had 2 that I can recall. On the annual anniversary date, you can opt to switch to the current interest rate if it is to your advantage. I have one of these currently, and it doesn't mature until 2025.

10:31 am

September 7, 2018

Offline

OfflineLoonie said

Preferred shares are a whole other issue and I'm sure there is a forum somewhere where their risks and possibilities can be more thoroughly discussed.

I am aware of Prefblog - it is not a good blog and there is no "discussion". So if anyone knows of a good forum where preferred shares are discussed, kindly let me know - I am always interested in expanding my knowledge.

10:44 am

October 21, 2013

Offline

Offline11:17 am

April 6, 2013

Offline

OfflinePrefBlog and the related $185/year PrefLetter are devoted to Canadian preferred shares.

I don't know if preferred shares are that exciting to discuss, aside from news of new ones coming onto the market.

They are a low-end way to speculate on interest rates for those who can't splurge on a few $100,000 board lots of marketable long term bonds. I don't think interest rate speculation is a good idea though.

Investment funds with research teams funded by budgets of $1 million+ a year can't predict interest rates. Not likely anyone who can't order $300,000 of bonds can either.

11:53 am

September 11, 2013

Offline

OfflineThere's a bunch of info re Cdn preferreds here, don't know if it's any good:

https://canadianpreferredshares.ca/

12:36 pm

September 7, 2018

Offline

OfflineNorman1 said

I don't know if preferred shares are that exciting to discuss, aside from news of new ones coming onto the market.

I agree preferred shares may not be exciting to discuss but the dividend rates of 4.5%, 4.75%, 5% (which I have had for 10 years) do satisfy me. Both you and I would be "excited" if HISAs and GICs paid just a bit closer to these rates.

2:06 pm

January 12, 2019

Offline

Offline.

Back to the subject at hand (2021 Inflation) . . .

A good article & vid on this, from BNN ➡ https://www.bnnbloomberg.ca/not-transitory-at-all-scotia-economist-sees-8-boc-rate-hikes-1.1669087

- Dean

" Live Long, Healthy ... And Prosper! "

" Live Long, Healthy ... And Prosper! "

2:45 pm

January 9, 2011

Offline

OfflineDean said

.

Back to the subject at hand (2021 Inflation) . . .A good article & vid on this, from BNN ➡ https://www.bnnbloomberg.ca/not-transitory-at-all-scotia-economist-sees-8-boc-rate-hikes-1.1669087

Dean

Excellent, thanks 🙂 Both videos were very informative. I also believe inflation isn't temporary, and the BofC won't react anywhere near fast enough.

"Keep your stick on the ice. Remember, I'm pulling for you. We're all in this together." - Red Green

4:25 pm

October 29, 2017

Offline

Offlinedougjp said

Excellent, thanks 🙂 Both videos were very informative. I also believe inflation isn't temporary, and the BofC won't react anywhere near fast enough.

They already have dragged their knuckles. October will be over by the next policy announcement! That means 5 months of high inflation. And, unless they are watching the economy with vigour and their finger on the hike button, another month will pass before we even get to see October inflation. They need to get moving, like yesterday! If they don’t raise rates next week, then December 8 is the next scheduled announcement.

5:32 pm

April 27, 2017

Offline

Offline6:50 pm

February 27, 2018

Offline

Offlineinflation. The problem is very easy to fix, you draw the conclusion.

Food prices are up. Loblaws will make close to a billion dollars profit in 2021. In the first quarter of 2021, Loblaws beat estimates by 30%.

Gas prices are up. The Americans pay (in Canadian dollars) 60 cents less a litre. That's 30 Canadian dollars LESS on a 50 litre fill up. But our air is cleaner than theirs.

Look at the money the Canadian banks bleed out of our economy.

6:59 pm

November 19, 2014

Offline

Offline7:38 pm

October 27, 2013

Offline

OfflineBill said

There's a bunch of info re Cdn preferreds here, don't know if it's any good:

https://canadianpreferredshares.ca/

There is discussion on preferreds at FWF https://www.financialwisdomforum.org/forum/viewtopic.php?t=113976 Start near the end of the thread, rather than at the start (2011)

Prefblog is not supposed to be for discussion. This is where James Hymas portfolio manager of https://www.himivest.com/malachite/MAPFMain.php provides a ton of free pricing analysis information to the consumer.

6:13 pm

April 6, 2013

Offline

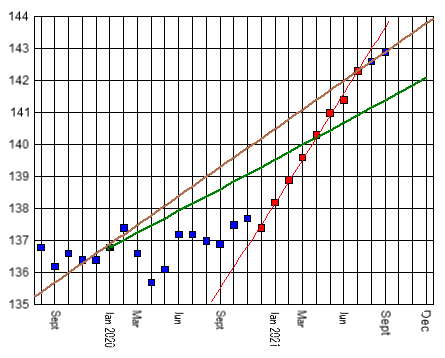

OfflineCPI inflation has actually moderated.

From January to July, CPI prices were advancing around 6% per annum as indicated by the red line:

That steep climb was broken from July to September when CPI prices advanced a more moderate 2.6% per annum as indicated by the brown line.

The green line illustrates a target 2% per annum inflation from pre-pandemic January 2020.

Two months is not enough to tell. But, things look promising! 🙂

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.