Topic RSS

Topic RSS

8:32 pm

October 27, 2013

Online

OnlineI will only speak for myself in saying the information has no real value to me in that it is not actionable in any practical way by me.

I take what money market funds and brokerage ISA deposit funds give me and all I know is they are directly influenced within days of the BoC making a rate announcement.

3:59 am

February 7, 2019

Offline

Offlinesmayer97 said

This has nothing to do with two groups agreeing to anything. This is simply about bringing to light simple cause and effect.

One of the most recycled argument on this forum. It would be much more entertaining and interesting to talk about what came first, the chicken or the egg ...

Signing off ...

| CGO |

11:08 am

September 29, 2017

Offline

Offlinemordko said

I don’t need to read the chart. Bank itself telegraphs its next moves well in advance and thats the guidance which is a key input into how the bonds are priced. Occasionally surprise datasets cause an unexpected move by the bank. Then the bond market reacts because expectations change. Like in January 2015 or July 2017.

NOPE. CB statements/guidance are simply TRYING to influence the markets... that is not causation.

mordko said

Do you know what correlation means? Yes, bonds and CofB overnight rates are positively correlated. That’s a “verifiable fact”. The fact a and b are correlated (which nobody disagrees with) tells us zero about causation. Nothing whatsoever. Regardless of the period of time you are looking at. Anyway, I am done.

What the MARKET DOES is ALL THAT MATTERS and may NOT be what the CB "guides". That is also a verifiable fact.

So again, what the CB says is immaterial, even though it might seem that way...

Do with it what you will.

11:11 am

September 29, 2017

Offline

Offlinecgouimet said

One of the most recycled argument on this forum. It would be much more entertaining and interesting to talk about what came first, the chicken or the egg ...

...

Again, this is FAR easier and clearer that chicken vs egg...

What I am presenting here is what has been shown through a very well established financial advisory service that has experts that have analysed and convincingly demonstrated this to be true, over and over and over again.

Based on this, I can always tell you what the most likely action by the CB will be by looking at the chart. There is NO WAY to guarantee or predict what the market will do when the CB gives "guidance"... it is as simple as that.

100% (or near that) is a lot easier to deal with than "maybe".

11:15 am

September 29, 2017

Offline

OfflineAltaRed said

I will only speak for myself in saying the information has no real value to me in that it is not actionable in any practical way by me.I take what money market funds and brokerage ISA deposit funds give me and all I know is they are directly influenced within days of the BoC making a rate announcement.

Well, what I can say is this is VERY actionable for me... It helped me be VERY CONFIDENT in locking into longer term GICs that I never like to do and catch the current top, AT (nearly) THE TOP (6%), VERY EASILY. I'd say that is very practical.

It also helps in seeing where mortgage rates are going and to plan accordingly (and yes, I know that mortgages are based more on longer term bond markets and other factors).

Any way, the purpose of this thread is to raise awareness for those who may never have seen this, and hopefully give them a clear and precise actionable tool, as it has been and continues to be for me.

11:31 am

March 30, 2017

Offline

Offlinei dont think I can follow what smayer97 is trying to say anymore. On multiple threads hes been preaching saying bond traders dictate short term interest rate, and CB just follow the bond traders / market rate. I am not sure if hes still saying the same or not.

That also has nothing to do with the ability or inability to forecast next CB move.

When the CB or in his argument (bond traders) already tells u what rates will be, its not a forecast, cuz you are explicitly "told". Also that is zero value added as every one can action on it, not like one can act ahead of the curve.

Think I am done with this discussion. Good for smayer97 to think its value added to him, whether real or not.

7:27 pm

September 29, 2017

Offline

OfflineI've never changed what I am saying... the short-term bond market is what will determine the next CB rate change, regardless of any influences leading up to the decision day. It is no more complicated than that.

So yes, it has EVERYTHING to do with be able to forecast the next CB move.

And if you pay close attention, you will notice that the CB also cannot give any better forecast. They just couch it in "sophisticated" language that makes it seem like they special insight. They do not.

And yes, it is a short term analysis. BUT it has proven itself time and again...

And financial services I follow with experts continue to prove that over and over, for decades.

And once you understand how this can be used, just like it has helped me, it can help others.

And you do not need to take my word for it. All they need to do is check it out.

11:30 am

April 6, 2013

Offline

Offlinesmayer97 said

I've never changed what I am saying... the short-term bond market is what will determine the next CB rate change, regardless of any influences leading up to the decision day. It is no more complicated than that.

…

No, it doesn't. Short-term bond rates do not determine central bank rate changes. It is the other way around.

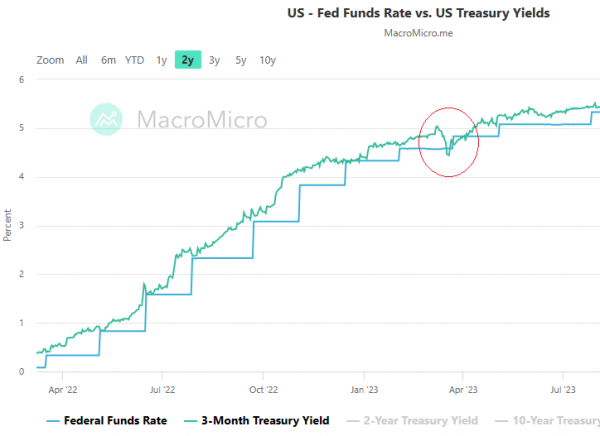

One can see an example of that in the US, around the US March 23 rate increase, from the link AltaRed provided. Short-term bond rates anticipated a central bank rate cut. It didn't happen and the short-term bond rates followed what US central bank actually did:

The Canadian and US central banks have decided to change their rates on eight fixed dates during the year unless there is some kind of emergency. Those dates are announced months in advance. These are the dates for this year for the Bank of Canada:

January 24

March 6

April 10

June 5

July 24

September 4

October 23

December 11

The central bank rates tend to lag the short-term bond rates because the central banks do not change those rates as the economic data (like inflation, unemployment, and housing starts) that those rate decisions are based on are released. The central banks will wait until the next date.

Central banks don't make it a secret and publish what they are trying to accomplish, what economic data they are using, and what they are seeing in the data.

In contrast, traders of short term bonds have not agreed to wait until the next date to change their bids/offers. The traders follow the economic data and what the central banks publish. The traders will try to anticiapte what the central banks will do on the next date.

There's no evidence to support claims that central banks take their lead from the bond markets. One saw in 2020 that central banks can actually enforce its policy rate on the markets. When there wasn't enough buyers then of treasury bills, bankers acceptances, and commercial paper at rates appropriate to the ¼% to ½% policy rates, the Bank of Canada stepped in with a quantitative easing program that bid for those short-term bonds appropriately to transmit those low policy rates into the economy.

12:26 pm

March 30, 2017

Offline

OfflineSmayer97 runs some correlation, concluded since bond market change is positively correlated with the subsequent CB change, it has to be the bond traders run the show, CB is just a puppy that follows bond traders around.

If anything the only force that may be able to influence a CB's near term rate decision is the stock market. Historically proven that when there is a blood bath type sell off / collapse in the stock market that may become contagious, CB's are more likely to react readily via rate cut. T-bill and short bond traders are well aware they have zero influence over the CBs.

3:49 pm

April 27, 2017

Offline

OfflineCB’s power over bond traders isn’t absolute either. I think that the bond market can force CB’s hand under certain circumstances. Bond traders are looking at the same data from the real economy as central bankers. Like inflation, employment , business confidence, fiscal policy, etc. Surely there is some influence going both ways.

Can’t see any value in knowing what everyone in the market knows anyway. If the claim of absolute control of short term yields over CBs were true, it would be completely useless.

On a different subject… yield curve has some predictive power which is more interesting if one is trying to guess expected returns and recession timing. We also know that the curve gets it wrong on a fairly regular basis.

5:20 pm

October 27, 2013

Online

OnlineNorman1 has got it right. The short term Tbill market is guessing what the BoC will do at the next rate setting, not the other way around. To help reinforce that, go to https://www.bankofcanada.ca/rates/interest-rates/t-bill-yields/ click off everything except 1 month and 3 month Tbills, resulting in 3 plots and expand to show whatever period you want, but for some granularity, expand to show only 2023 and 2024 and observe market behaviour, including an anticipation of a March 6th 2024 cut of 25bp. (1 month at 4.74%) and 3 month following at 4.82%. Since the rate cut didn't happen, bookmark that link and come back in July this year and look at month to month behaviour between now and then.

5:34 pm

February 7, 2019

Offline

Offlinezgic said

Start of 2024, Markets were predicting 6 rate cuts for 2024 in the US.

After the Fed looked at the data coming in 2024, now it might make none or 1 or 2 cuts max. Again this is short term.

Who is guiding the ship here? looks like the FED

Perhaps they had Heinz97  spiked cheeseburgers that influenced their decision.

spiked cheeseburgers that influenced their decision.

| CGO |

5:51 pm

April 27, 2017

Offline

Offlinezgic said

Start of 2024, Markets were predicting 6 rate cuts for 2024 in the US.

After the Fed looked at the data coming in 2024, now it might make none or 1 or 2 cuts max. Again this is short term.

Who is guiding the ship here? looks like the FED

It looks like real economic data is guiding the ship. Inflation, jobs, etc. Feds and bond markets respond.

5:55 pm

August 30, 2023

Offline

Offlinemordko said

It looks like real economic data is guiding the ship. Inflation, jobs, etc. Feds and bond markets respond.

No one can predict the ECONOMY AND RATES. - Warren Buffett

Since we were just discussing Markets and Fed, I used FED.

You are correct - WRONG PREDICTIONS (MARKETS) -> REAL DATA -> THE FED -> MARKETS

Let's use this formula.

10:16 pm

September 29, 2017

Offline

Offline10:25 pm

September 29, 2017

Offline

OfflineAs for Norman1's chart... funny how you focus on the one "outlier" but miss the other 11 in the same chart. And if you study the "outlier", you will see that it is not quite what you posit it to be. In the end, the market still drove the direction.

And I have examined decades of these "correlations" and it is near 100%, leading any changes the CB makes.

It is interesting that folks here will acknowledge that the CB changes lag, but then how does that become a leading indicator?

zgic said

Start of 2024, Markets were predicting 6 rate cuts for 2024 in the US.

After the Fed looked at the data coming in 2024, now it might make none or 1 or 2 cuts max. Again this is short term.

Who is guiding the ship here? looks like the FED

They are just opining, like everyone else.

Of course, as has been pointed out, both the market and the CB see the same info. But if I have to make decisions on where the rates are going in the short term, the market data is far more determinant to help make decisions than ANY talking points of the CB or other pundits, simply because the CB lags what is happening.

I'll point out that none of these are my original thoughts...these are based on years of research and well presented cases by other published experts that show this to be highly reliable.

Do with it what you will. All I know is that it works for me to make money.

3:53 am

April 27, 2017

Offline

OfflineYou can’t “make money” by knowing BoC’s next move a month in advance. Everyone else knows it too, with a high degree of certainty (some exceptions , as always). Its not a secret at all.

You can make money if you know forward guidance. Particularly if it has surprises. Thats what markets react to. Surprising guidance isn’t in the short term bond rates.

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.