Topic RSS

Topic RSS

1:09 pm

December 1, 2016

Offline

OfflineHello fellow HIS community,

I have been scouring the web to find the correct answer, including this forum, but have been unsuccessful.

My questions are:

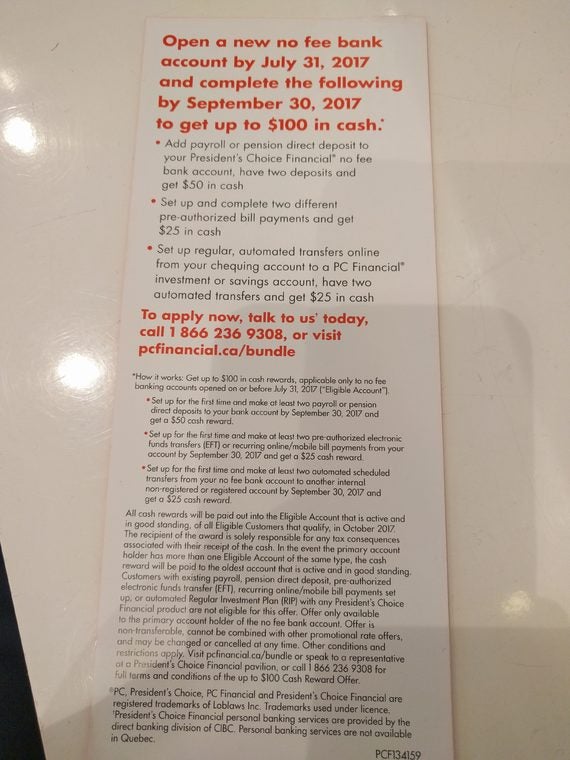

1) the bonus incentive offers that banks give to prospective bank clients for opening a new account or referral bonuses, is that bonus money taxable? Does the CRA expect that money to be declared?

2) Cash earned from cash back credit cards, does that money have to be declared?

From what I have found online, I've read yes because you need to claim ALL income, but others stated that it is considered "refund" money and therefore you do not have to declare it.

Thoughts?

2:06 pm

April 6, 2013

Offline

OfflineThere was a previous discussion about that here.

Bonus offers are like those toasters banks used to give out. Cash backs are like discounts and rebates.

2:46 pm

December 17, 2016

Offline

OfflineNorman1 said

Bonus offers are like those toasters banks used to give out.

Ah yes, nothing quite like the good old days ...

"Put as little as $869 in a 20-year certificate of deposit, and the Traverse City, Mich.-based bank will hand over a Weatherby Inc. Mark V Synthetic rifle that normally lists for $779. Deposit more and you have a choice of six Weatherby shotguns or a limited-edition rifle with walnut stock and oak-leaf engravings.

The bank has 28 branches, mostly in Michigan's Upper Peninsula, and the guns-for-CDs program is a potent weapon in the fight for Americans' savings at a time of shrinking bank deposits.

Banks across the country are offering everything from $50 gift certificates and books to casserole dishes and clocks - even toasters - to lure back customers and stem a seven-year decline in deposits as Americans shifted money into stocks and mutual funds."

3:16 pm

October 21, 2013

Offline

Offline7:20 am

September 5, 2013

Offline

Offline12:22 pm

December 1, 2016

Offline

Offline12:39 pm

September 11, 2013

Offline

OfflineTo me this is a non-issue. First, random gifts received outside of employer-employee relationships are generally not taxable income.

Plus, even if it was taxable if you get $100 a year in promo money or whatever you want to call it, do you really think CRA is going to pull you up for audit for the $40 or so in taxes? And if their computer finds it somehow and they send you a letter then send them a cheque for $40 (plus a bit of interest), done. CRA does not reassess further back than 2 years, sometimes 3 (unless there's fraud).

So I wouldn't worry about this.

Log In

Log In Register

Register Home

Home

Facebook

Facebook Twitter

Twitter Email this

Email this

Please write your comments in the forum.