Neo Financial currently has a competitive placement on our savings account comparison chart, but has been controversial to Canadian savers for at least a couple of reasons. It is not a financial institution, and it currently does not have a traditional browser-based online banking interface. You can only access its savings account through its mobile app. Here’s some screenshot-heavy documentation of Neo Financial’s account opening process.

Note that the first couple of screenshots were taken in November, when it wasn’t yet possible to open Neo Financial’s savings account (called “Neo Savings”) without first applying for a Neo Financial credit card; the bulk of the screenshots were taken at the end of April.

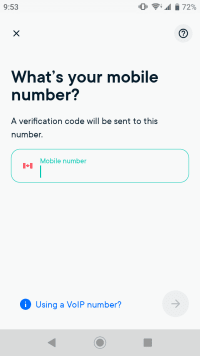

The first step after downloading the Neo Financial app (on an Android device in this case) is to enter your mobile phone number and validate it by entering a numerical code that the app sends you.

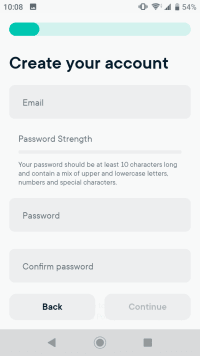

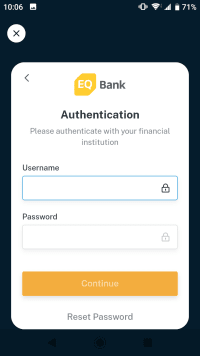

Then, you can create a username and password for your Neo Financial account:

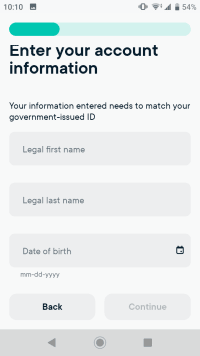

It will then proceed to ask you for your personal information, including your first name, last name, and birth date:

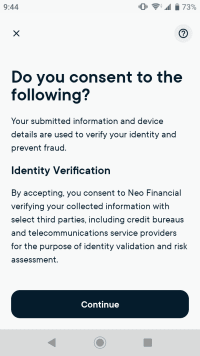

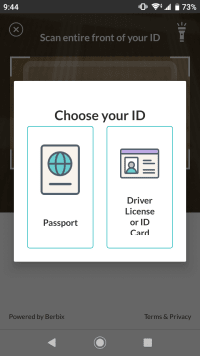

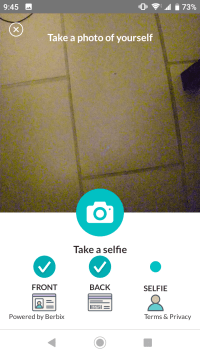

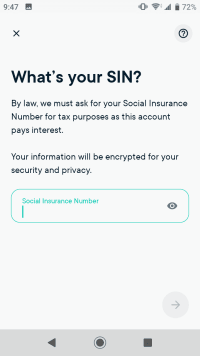

To verify your identity, it will make you take a picture of your passport or driver’s licence, take a selfie, and enter your Social Insurance Number:

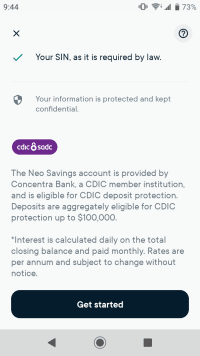

It does call out that Concentra Bank is where your money will be deposited:

The Neo Savings account is provided by Concentra Bank, a CDIC member institution, and is eligible for CDIC deposit protection. Deposits are aggregately eligible for CDIC protection up to $100,000.

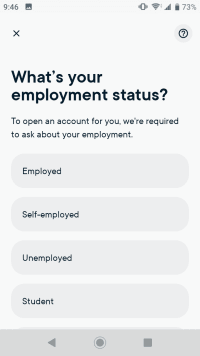

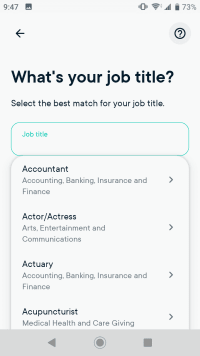

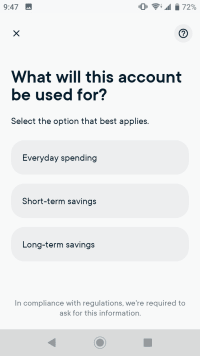

Before entering your Social Insurance Number, you must enter your employment status and job title, as well as the intended purpose of the account:

Then, your sign-up is complete:

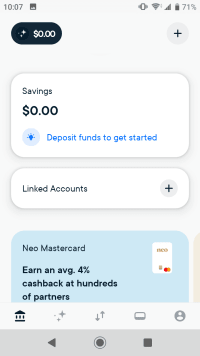

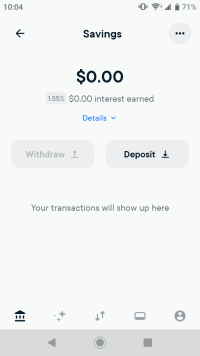

The entire process took less than 10 minutes in this case, although of course it could take more or less time for you. You then have a savings account:

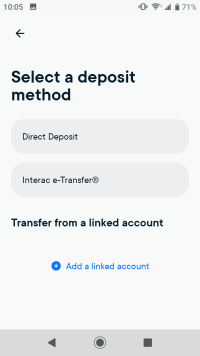

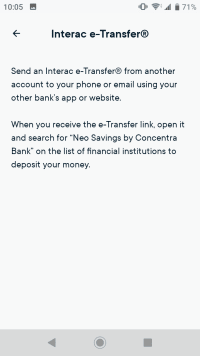

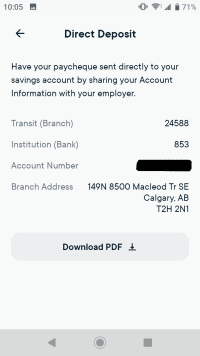

There are a few ways to deposit money into the account: send yourself an Interac e-Transfer, push the funds from another financial institution using the account’s direct deposit details, or pull the funds from another financial institution. Note that mobile cheque deposit is not yet supported.

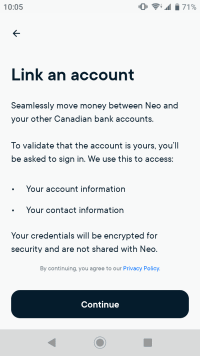

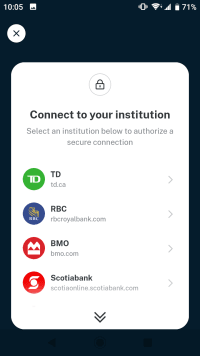

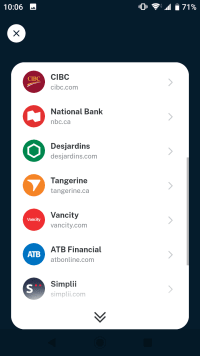

Pulling money from another financial institution can only be done by signing in to the other account through the app’s account linking feature. Below, you’ll see that the major banks and only some other financial institutions are supported:

As of the beginning of May, the supported financial institutions in the account linking feature are:

- TD Canada Trust

- RBC Royal Bank

- BMO Bank of Montreal

- Scotiabank

- CIBC

- National Bank

- Desjardins Bank

- Tangerine Bank

- Vancity Credit Union

- ATB Financial

- Simplii Financial

- Meridian Credit Union

- HSBC

- EQ Bank

Getting money out of a Neo Savings account can be done by pushing funds from Neo Financial, pulling funds from the other financial institution, sending an Interac e-Transfer, or paying a bill.

| Forum/Topic | Started | Last post | Posts |

|---|---|---|---|

|

Neo Financial |

6 | ||

|

Neo Financial |

3 | ||

|

Neo Financial The interest rate on HISA account will be changing from 4.00% to 3.00%, as of November 1, 2024. |

1 | ||

|

Neo Financial |

9 | ||

|

Neo Financial |

12 |