It seems like every few days, we’re tracking yet another savings account interest rate drop. Since the beginning of December, 15 out of 19 bank accounts we track have experienced a rate decrease. One of the exceptions is the PC Money account, which we only recently added to our comparison chart. It’s by far the current rate leader at 4.00%, with the next highest rate being Wealth One Bank of Canada at 3.20% (which is also the highest non-promo TFSA rate).

The top GIC rates on our GIC comparison chart are as follows, compared to what the highest rate was 1 year ago:

- 1-year: 4.00% (5.70% a year ago)

- 2-year: 3.95% (5.60% a year ago)

- 3-year: 3.75% (5.30% a year ago)

- 4-year: 3.65% (5.00% a year ago)

- 5-year: 3.70% (5.00% a year ago)

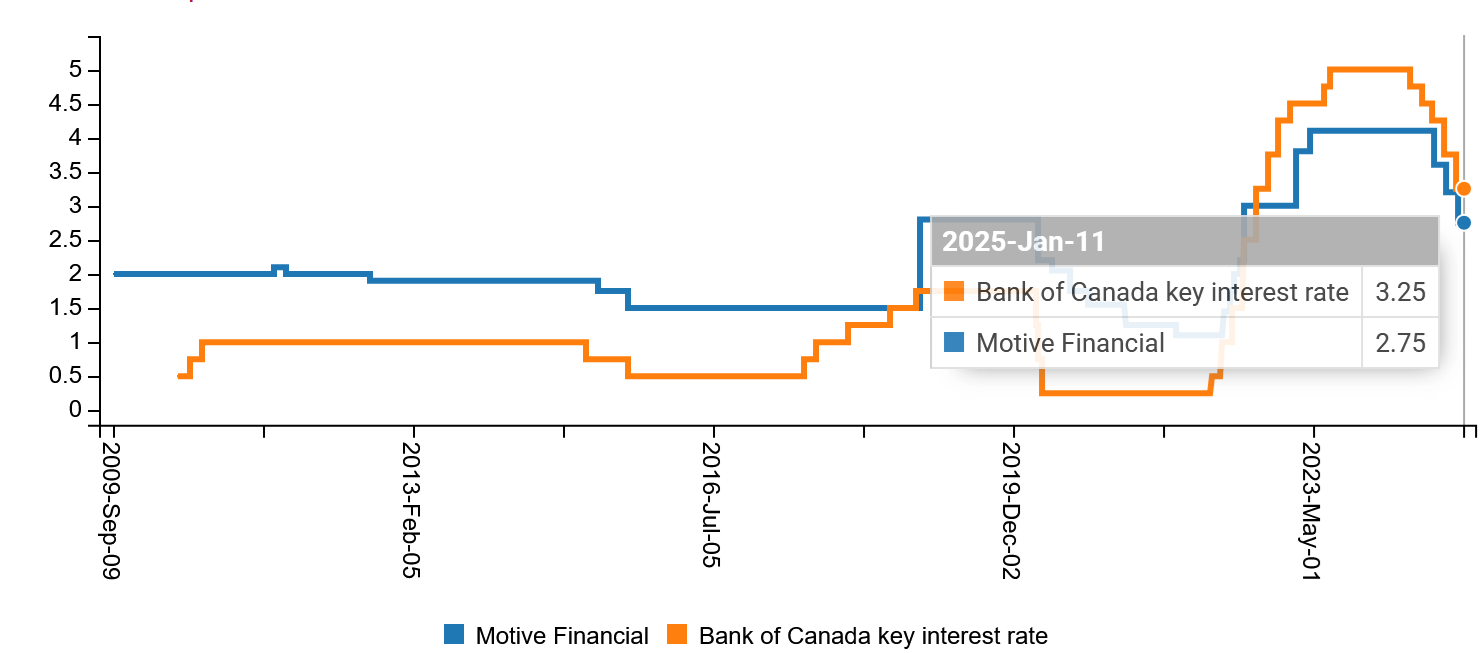

Graphing savings account rates against Bank of Canada rates

One of the features on our website is the ability to compare savings account interest rate histories between financial institutions. Now we’ve added the Bank of Canada policy interest rates going back to 2010 to our database, so you can graph it against savings accounts.

For example, here’s Motive Financial vs the Bank of Canada’s key interest rate:

TFSA promos

We’re tracking TFSA (and non-TFSA) promos on our promotions page, where one of the headline promotions is a 2% match on new deposits at EQ Bank until the end of February. Remember to consider what the rate will be when a promo ends, since your funds will have to stay at that financial institution for the rest of the calendar year unless you withdraw it or transfer it to another TFSA.

How much do you have in your TFSA?

If you turned at least 18 in 2009, your cumulative TFSA contribution room, including this year’s $7,000 limit, is $102,000.

CRA stats indicate that for the 2022 tax year, the average value of a TFSA by age group was:

- 24 or younger: $6,168

- 25 to 34: $12,480

- 35 to 44: $16,552

- 45 to 54: $23,847

- 55 to 64: $36,625

- 65+: $50,918

Quick notes

- CDIC protection for Wealthsimple Cash accounts has increased to $1 million

- $0 and $4 bank accounts are coming to Canada’s big banks by December 1, 2025. Will these accounts be worth considering?

- Discussion: how to invest money for your 13 year old?